Page 220 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 220

Unit 12: Fund Flow Analysis

Notes

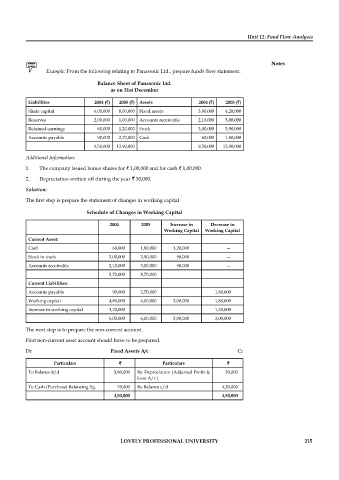

Example: From the following relating to Panasonic Ltd., prepare funds fl ow statement.

Balance Sheet of Panasonic Ltd.

as on 31st December

Liabilities 2004 (`) 2005 (`) Assets 2004 (`) 2005 (`)

Share capital 6,00,000 8,00,000 Fixed assets 3,80,000 4,20,000

Reserves 2,00,000 1,00,000 Accounts receivable 2,10,000 3,00,000

Retained earnings 60,000 1,20,000 Stock 3,00,000 3,90,000

Accounts payable 90,000 2,70,000 Cash 60,000 1,80,000

9,50,000 12,90,000 9,50,000 12,90,000

Additional Information:

1. The company issued bonus shares for ` 1,00,000 and for cash ` 1,00,000.

2. Depreciation written off during the year ` 30,000.

Solution:

The first step is prepare the statement of changes in working capital

Schedule of Changes in Working Capital

2004 2005 Increase in Decrease in

Working Capital Working Capital

Current Asset:

Cash 60,000 1,80,000 1,20,000 —

Stock in trade 3,00,000 3,90,000 90,000 —

Accounts receivable 2,10,000 3,00,000 90,000 —

5,70,000 8,70,000

Current Liabilities:

Accounts payable 90,000 2,70,000 1,80,000

Working capital 4,80,000 6,00,000 3,00,000 1,80,000

Increase in working capital 1,20,000 1,20,000

6,00,000 6,00,000 3,00,000 3,00,000

The next step is to prepare the non-current account.

First non-current asset account should have to be prepared.

Dr Fixed Assets A/c Cr

Particulars ` ` Particulars ` `

To Balance b/d 3,80,000 By Depreciation (Adjusted Profi t & 30,000

Loss A/c )

To Cash (Purchase) Balancing fig. 70,000 By Balance c/d 4,20,000

4,50,000 4,50,000

LOVELY PROFESSIONAL UNIVERSITY 215