Page 215 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 215

Cost and Management Accounting

Notes Solution:

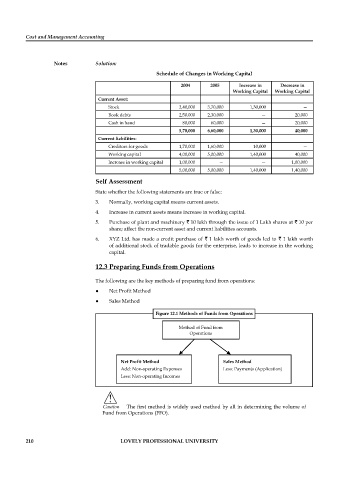

Schedule of Changes in Working Capital

2004 2005 Increase in Decrease in

Working Capital Working Capital

Current Asset:

Stock 2,40,000 3,70,000 1,30,000 —

Book debts 2,50,000 2,30,000 — 20,000

Cash in hand 80,000 60,000 — 20,000

5,70,000 6,60,000 1,30,000 40,000

Current liabilities:

Creditors for goods 1,70,000 1,60,000 10,000 —

Working capital 4,00,000 5,00,000 1,40,000 40,000

Increase in working capital 1,00,000 — — 1,00,000

5,00,000 5,00,000 1,40,000 1,40,000

Self Assessment

State whether the following statements are true or false:

3. Normally, working capital means current assets.

4. Increase in current assets means increase in working capital.

5. Purchase of plant and machinery ` 10 lakh through the issue of 1 Lakh shares at ` 10 per

share; affect the non-current asset and current liabilities accounts.

6. XYZ Ltd. has made a credit purchase of ` 1 lakh worth of goods led to ` 1 lakh worth

of additional stock of tradable goods for the enterprise, leads to increase in the working

capital.

12.3 Preparing Funds from Operations

The following are the key methods of preparing fund from operations:

Net Profi t Method

Sales Method

Figure 12.1 Methods of Funds from Operations

Method of Fund from

Operations

Net Profit Method Sales Method

Add: Non-operating Expenses Less: Payments (Application)

Less: Non-operating Incomes

!

Caution The first method is widely used method by all in determining the volume of

Fund from Operations (FFO).

210 LOVELY PROFESSIONAL UNIVERSITY