Page 216 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 216

Unit 12: Fund Flow Analysis

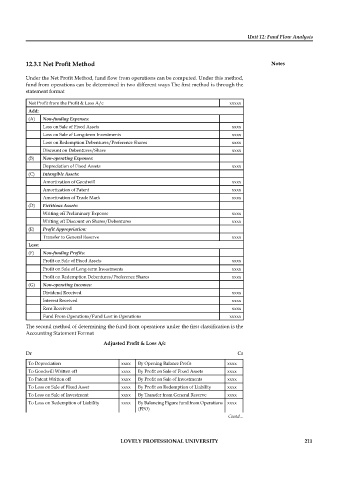

12.3.1 Net Profi t Method Notes

Under the Net Profit Method, fund flow from operations can be computed. Under this method,

fund from operations can be determined in two different ways The fi rst method is through the

statement format

Net Profit from the Profit & Loss A/c xxxxx

Add:

(A) Non-funding Expenses:

Loss on Sale of Fixed Assets xxxx

Loss on Sale of Long-term Investments xxxx

Loss on Redemption Debentures/Preference Shares xxxx

Discount on Debentures/Share xxxx

(B) Non-operating Expenses:

Depreciation of Fixed Assets xxxx

(C) Intangible Assets:

Amortization of Goodwill xxxx

Amortization of Patent xxxx

Amortization of Trade Mark xxxx

(D) Fictitious Assets:

Writing off Preliminary Expense xxxx

Writing off Discount on Shares/Debentures xxxx

(E) Profi t Appropriation:

Transfer to General Reserve xxxx

Less:

(F) Non-funding Profi ts:

Profit on Sale of Fixed Assets xxxx

Profit on Sale of Long-term Investments xxxx

Profit on Redemption Debentures/Preference Shares xxxx

(G) Non-operating Incomes:

Dividend Received xxxx

Interest Received xxxx

Rent Received xxxx

Fund From Operations/Fund Lost in Operations xxxxx

The second method of determining the fund from operations under the fi rst classification is the

Accounting Statement Format

Adjusted Profit & Loss A/c

Dr Cr

To Depreciation xxxx By Opening Balance Profi t xxxx

To Goodwill Written off xxxx By Profit on Sale of Fixed Assets xxxx

To Patent Written off xxxx By Profit on Sale of Investments xxxx

To Loss on Sale of Fixed Asset xxxx By Profit on Redemption of Liability xxxx

To Loss on Sale of Investment xxxx By Transfer from General Reserve xxxx

To Loss on Redemption of Liability xxxx By Balancing Figure fund from Operations xxxx

(FFO)

Contd...

LOVELY PROFESSIONAL UNIVERSITY 211