Page 146 - DMGT207_MANAGEMENT_OF_FINANCES

P. 146

Unit 6: Capital Budgeting

line depreciation. In our example, the depreciation can be calculated with two formulas as Notes

follows:

Depreciable Cost = Total Cost of machine – Book salvage value

2,40,000 – 40,000 = 2,00,000

Annual Depreciation = Depreciable Cost/Years of life

= 2,00,000/4 = 50,000

With the straight-line method, 50,000 depreciation is the same for each of the four years of the

new machines estimated service life. With other methods, the amount of depreciation differs

each year.

The depreciation on the existing machine is given at 20,000 per year down to zero book value.

Since the current book value is 80,000, the annual depreciation of 20,000 will be realised for

the remaining four years of service life.

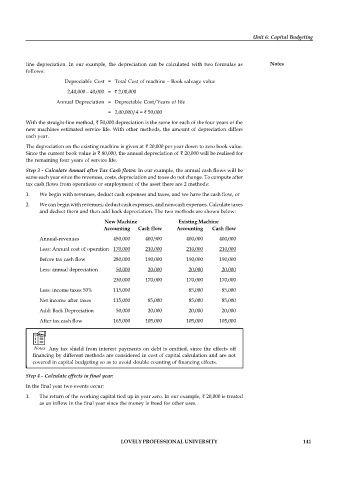

Step 3 - Calculate Annual after Tax Cash flows: In our example, the annual cash flows will be

same each year since the revenues, costs, depreciation and taxes do not change. To compute after

tax cash flows from operations or employment of the asset there are 2 methods:

1. We begin with revenues, deduct cash expenses and taxes, and we have the cash flow, or

2. We can begin with revenues; deduct cash expenses, and non-cash expenses. Calculate taxes

and deduct them and then add back depreciation. The two methods are shown below:

New Machine Existing Machine

Accounting Cash flow Accounting Cash flow

Annual-revenues 450,000 400,900 400,000 400,000

Less: Annual cost of operation 170,000 210,000 210,000 210,000

Before tax cash flow 280,000 190,000 190,000 190,000

Less: annual depreciation 50,000 20,000 20,000 20,000

230,000 170,000 170,000 170,000

Less: income taxes 50% 115,000 85,000 85,000

Net income after taxes 115,000 85,000 85,000 85,000

Add: Back Depreciation 50,000 20,000 20,000 20,000

After tax cash flow 165,000 105,000 105,000 105,000

Notes Any tax shield from interest payments on debt is omitted, since the effects off

financing by different methods are considered in cost of capital calculation and are not

covered in capital budgeting so as to avoid double counting of financing effects.

Step 4 - Calculate effects in final year:

In the final year two events occur:

1. The return of the working capital tied up in year zero. In our example, 20,000 is treated

as an inflow in the final year since the money is freed for other uses.

LOVELY PROFESSIONAL UNIVERSITY 141