Page 150 - DMGT207_MANAGEMENT_OF_FINANCES

P. 150

Unit 6: Capital Budgeting

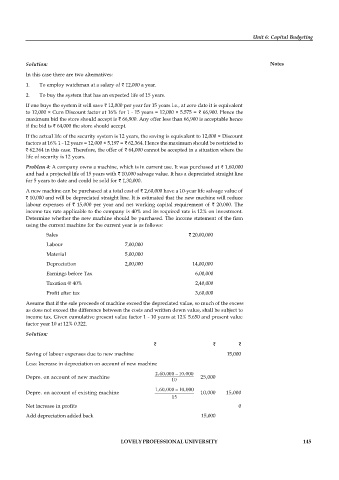

Solution: Notes

In this case there are two alternatives:

1. To employ watchman at a salary of 12,000 a year.

2. To buy the system that has an expected life of 15 years.

If one buys the system it will save 12,000 per year for 15 years i.e., at zero date it is equivalent

to 12,000 × Cum Discount factor at 16% for 1 - 15 years = 12,000 × 5.575 = 66,900. Hence the

maximum bid the store should accept is 66,900. Any offer less than 66,900 is acceptable hence

if the bid is 64,000 the store should accept.

If the actual life of the security system is 12 years, the saving is equivalent to 12,000 × Discount

factors at 16% 1 - 12 years = 12,000 × 5,197 = 62,364. Hence the maximum should be restricted to

62.364 in this case. Therefore, the offer of 64,000 cannot be accepted in a situation where the

life of security is 12 years.

Problem 4: A company owns a machine, which is in current use. It was purchased at 1,60,000

and had a projected life of 15 years with 10,000 salvage value. It has a depreciated straight line

for 5 years to date and could be sold for 1,30,000.

A new machine can be purchased at a total cost of 2,60,000 have a 10-year life salvage value of

10,000 and will be depreciated straight line. It is estimated that the new machine will reduce

labour expenses of 15,000 per year and net working capital requirement of 20,000. The

income tax rate applicable to the company is 40% and its required rate is 12% on investment.

Determine whether the new machine should be purchased. The income statement of the firm

using the current machine for the current year is as follows:

Sales 20,00,000

Labour 7,00,000

Material 5,00,000

Depreciation 2,00,000 14,00,000

Earnings before Tax 6,00,000

Taxation @ 40% 2,40,000

Profit after tax 3,60,000

Assume that if the sale proceeds of machine exceed the depreciated value, so much of the excess

as does not exceed the difference between the costs and written down value, shall be subject to

income tax. Given cumulative present value factor 1 - 10 years at 12% 5.650 and present value

factor year 10 at 12% 0.322.

Solution:

Saving of labour expenses due to new machine 15,000

Less: Increase in depreciation on account of new machine

Depre. on account of new machine 25,000

Depre. on account of existing machine 10,000 15,000

Net increase in profits 0

Add depreciation added back 15,000

LOVELY PROFESSIONAL UNIVERSITY 145