Page 152 - DMGT207_MANAGEMENT_OF_FINANCES

P. 152

Unit 6: Capital Budgeting

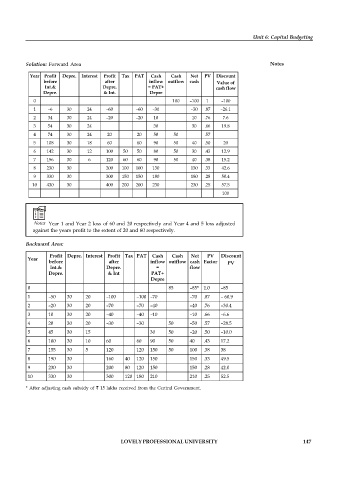

Solution: Forward Area Notes

Year Profit Depre. Interest Profit Tax PAT Cash Cash Net PV Discount

before after inflow outflow cash Value of

Int.& Depre. = PAT+ cash flow

Depre. & Int. Depre

0 100 –100 1 –100

1 –6 30 24 –60 –60 –30 –30 .87 –26.1

2 34 30 24 –20 –20 10 10 .76 7.6

3 54 30 24 30 30 .66 19.8

4 74 30 24 20 20 50 50 .57

5 108 30 18 60 60 90 50 40 .50 20

6 142 30 12 100 50 50 80 50 30 .43 12.9

7 156 30 6 120 60 60 90 50 40 .38 15.2

8 230 30 200 100 100 130 130 .33 42.6

9 330 30 300 150 150 180 180 .28 50.4

10 430 30 400 200 200 230 230 .25 57.5

100

Notes Year 1 and Year 2 loss of 60 and 20 respectively and Year 4 and 5 loss adjusted

against the years profit to the extent of 20 and 60 respectively.

Backward Area:

Profit Depre. Interest Profit Tax PAT Cash Cash Net PV Discount

Year

before after inflow outflow cash Factor PV

Int.& Depre. = flow

Depre. & Int PAT+

Depre

0 85 –85* 1.0 –85

1 –50 30 20 –100 –100 –70 –70 .87 – 60.9

2 –20 30 20 –70 –70 –40 –40 .76 –30.4

3 10 30 20 –40 –40 –10 –10 .66 –6.6

4 20 30 20 –30 –30 50 –50 .57 –28.5

5 45 30 15 30 50 –20 .50 –10.0

6 100 30 10 60 60 90 50 40 .43 17.2

7 155 30 5 120 120 150 50 100 .38 38

8 190 30 160 40 120 150 150 .33 49.5

9 230 30 200 80 120 150 150 .28 42.0

10 330 30 300 120 180 210 210 .25 52.5

* After adjusting cash subsidy of 15 lakhs received from the Central Government.

LOVELY PROFESSIONAL UNIVERSITY 147