Page 159 - DMGT303_BANKING_AND_INSURANCE

P. 159

Banking and Insurance

Notes 8.2.2 Bill of Exchange

Suppose Rajiv has given a loan of Rupees Ten Thousand to Sameer, which Sameer has to return.

Now, Rajiv also has to give some money to Tarun. In this case, Rajiv can make a document

directing Sameer to make payment up to Rupees Ten Thousand to Tarun on demand or after

expiry of a specified period. This document is called a Bill of Exchange, which can be transferred

to some other person's name by Tarun.

Section 5 of the Negotiable Instruments Act, 1881 defines a bill of exchange as 'an instrument in

writing containing an unconditional order, signed by the maker, directing a certain person to

pay a certain sum of money only to or to the order of a certain person, or to the bearer of the

instrument'.

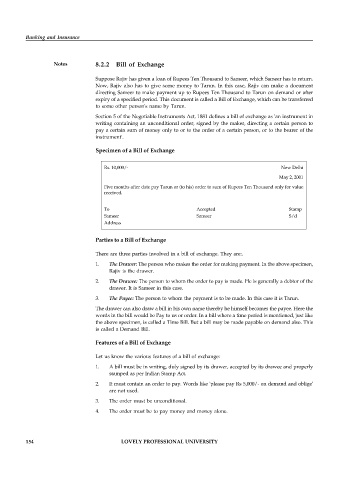

Specimen of a Bill of Exchange

Rs. 10,000/- New Delhi

May 2, 2001

Five months after date pay Tarun or (to his) order to sum of Rupees Ten Thousand only for value

received.

To Accepted Stamp

Sameer Sameer S/d

Address

Parties to a Bill of Exchange

There are three parties involved in a bill of exchange. They are:.

1. The Drawer: The person who makes the order for making payment. In the above specimen,

Rajiv is the drawer.

2. The Drawee: The person to whom the order to pay is made. He is generally a debtor of the

drawer. It is Sameer in this case.

3. The Payee: The person to whom the payment is to be made. In this case it is Tarun.

The drawer can also draw a bill in his own name thereby he himself becomes the payee. Here the

words in the bill would be Pay to us or order. In a bill where a time period is mentioned, just like

the above specimen, is called a Time Bill. But a bill may be made payable on demand also. This

is called a Demand Bill.

Features of a Bill of Exchange

Let us know the various features of a bill of exchange:

1. A bill must be in writing, duly signed by its drawer, accepted by its drawee and properly

stamped as per Indian Stamp Act.

2. It must contain an order to pay. Words like 'please pay Rs 5,000/- on demand and oblige'

are not used.

3. The order must be unconditional.

4. The order must be to pay money and money alone.

154 LOVELY PROFESSIONAL UNIVERSITY