Page 160 - DMGT303_BANKING_AND_INSURANCE

P. 160

Unit 8: Negotiable Instruments

5. The sum payable mentioned must be certain or capable of being made certain. Notes

6. The parties to a bill must be certain.

!

Caution Words like 'please pay Rs 5,000/- on demand and oblige' should not be used in

Bill of Exchange.

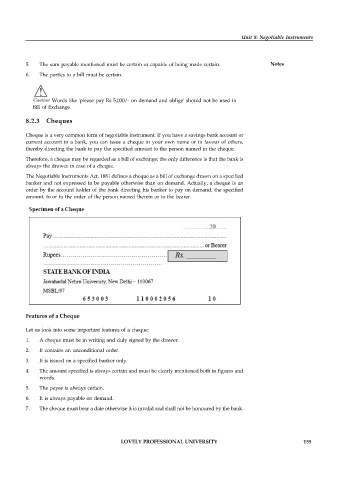

8.2.3 Cheques

Cheque is a very common form of negotiable instrument. If you have a savings bank account or

current account in a bank, you can issue a cheque in your own name or in favour of others,

thereby directing the bank to pay the specified amount to the person named in the cheque.

Therefore, a cheque may be regarded as a bill of exchange; the only difference is that the bank is

always the drawee in case of a cheque.

The Negotiable Instruments Act, 1881 defines a cheque as a bill of exchange drawn on a specified

banker and not expressed to be payable otherwise than on demand. Actually, a cheque is an

order by the account holder of the bank directing his banker to pay on demand, the specified

amount, to or to the order of the person named therein or to the bearer.

Features of a Cheque

Let us look into some important features of a cheque:

1. A cheque must be in writing and duly signed by the drawer.

2. It contains an unconditional order.

3. It is issued on a specified banker only.

4. The amount specified is always certain and must be clearly mentioned both in figures and

words.

5. The payee is always certain.

6. It is always payable on demand.

7. The cheque must bear a date otherwise it is invalid and shall not be honoured by the bank.

LOVELY PROFESSIONAL UNIVERSITY 155