Page 163 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 163

Accounting for Managers

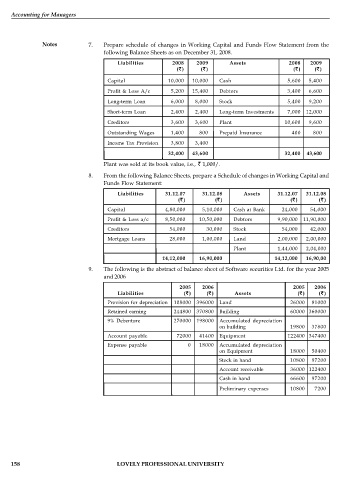

Notes 7. Prepare schedule of changes in Working Capital and Funds Flow Statement from the

following Balance Sheets as on December 31, 2008.

Liabilities 2008 2009 Assets 2008 2009

( ) ( ) ( ) ( )

Capital 10,000 10,000 Cash 5,600 5,400

Profit & Loss A/c 5,200 15,400 Debtors 3,400 6,600

Long-term Loan 6,000 8,000 Stock 5,400 9,200

Short-term Loan 2,400 2,400 Long-term Investments 7,000 12,000

Creditors 3,600 3,600 Plant 10,600 9,600

Outstanding Wages 1,400 800 Prepaid Insurance 400 800

Income Tax Provision 3,800 3,400

32,400 43,600 32,400 43,600

Plant was sold at its book value, i.e., 1,000/.

8. From the following Balance Sheets, prepare a Schedule of changes in Working Capital and

Funds Flow Statement:

Liabilities 31.12.07 31.12.08 Assets 31.12.07 31.12.08

( ) ( ) ( ) ( )

Capital 4,80,000 5,10,000 Cash at Bank 24,000 54,000

Profit & Loss a/c 8,50,000 10,50,000 Debtors 9,90,000 11,90,000

Creditors 54,000 30,000 Stock 54,000 42,000

Mortgage Loans 28,000 1,00,000 Land 2,00,000 2,00,000

Plant 1,44,000 2,04,000

14,12,000 16,90,000 14,12,000 16,90,00

9. The following is the abstract of balance sheet of Software securities Ltd. for the year 2005

and 2006

2005 2006 2005 2006

Liabilities ( ) ( ) Assets ( ) ( )

Provision for depreciation 108000 396000 Land 26000 81000

Retained earning 244800 370800 Building 60000 360000

9% Debenture 270000 198000 Accumulated depreciation

on building 19800 37800

Account payable 72000 41400 Equipment 122400 347400

Expense payable 0 18000 Accumulated depreciation

on Equipment 18000 50400

Stock in hand 10800 97200

Account receivable 36000 122400

Cash in hand 66600 97200

Preliminary expenses 10800 7200

158 LOVELY PROFESSIONAL UNIVERSITY