Page 159 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 159

Accounting for Managers

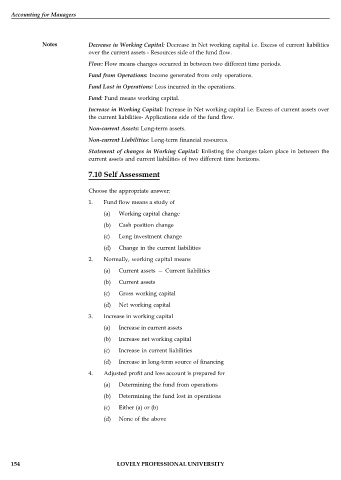

Notes Decrease in Working Capital: Decrease in Net working capital i.e. Excess of current liabilities

over the current assets - Resources side of the fund flow.

Flow: Flow means changes occurred in between two different time periods.

Fund from Operations: Income generated from only operations.

Fund Lost in Operations: Loss incurred in the operations.

Fund: Fund means working capital.

Increase in Working Capital: Increase in Net working capital i.e. Excess of current assets over

the current liabilities- Applications side of the fund flow.

Non-current Assets: Long-term assets.

Non-current Liabilities: Long-term financial resources.

Statement of changes in Working Capital: Enlisting the changes taken place in between the

current assets and current liabilities of two different time horizons.

7.10 Self Assessment

Choose the appropriate answer:

1. Fund flow means a study of

(a) Working capital change

(b) Cash position change

(c) Long investment change

(d) Change in the current liabilities

2. Normally, working capital means

(a) Current assets — Current liabilities

(b) Current assets

(c) Gross working capital

(d) Net working capital

3. Increase in working capital

(a) Increase in current assets

(b) Increase net working capital

(c) Increase in current liabilities

(d) Increase in long-term source of financing

4. Adjusted profit and loss account is prepared for

(a) Determining the fund from operations

(b) Determining the fund lost in operations

(c) Either (a) or (b)

(d) None of the above

154 LOVELY PROFESSIONAL UNIVERSITY