Page 156 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 156

Increase in Working

1995

1994

Capital Decrease in Working

Capital

Current Asset:

Cash 60,000 1,80,000 1,20,000 —

Stock in trade 3,00,000 3,90,000 90,000 —

Accounts receivable 2,10,000 3,00,000 90,000 —

Unit 7: Fund Flow Statement

5,70,000 8,70,000

Current Liabilities:

Accounts payable 90,000 2,70,000 1,80,000

Notes

Working capital 4,80,000 6,00,000 3,00,000 1,80,000

Increase in working 1,20,000 1,20,000

capital

6,00,000 6,00,000 3,00,000 3,00,000

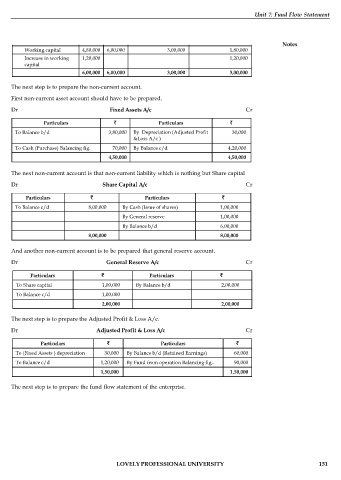

The next step is to prepare the non-current account.

First non-current asset account should have to be prepared.

Dr Fixed Assets A/c Cr

Particulars Particulars

To Balance b/d 3,80,000 By Depreciation (Adjusted Profit 30,000

&Loss A/c )

To Cash (Purchase) Balancing fig. 70,000 By Balance c/d 4,20,000

4,50,000 4,50,000

The next non-current account is that non-current liability which is nothing but Share capital

Dr Share Capital A/c Cr

Particulars Particulars

To Balance c/d 8,00,000 By Cash (Issue of shares) 1,00,000

By General reserve 1,00,000

By Balance b/d 6,00,000

8,00,000 8,00,000

And another non-current account is to be prepared that general reserve account.

Dr General Reserve A/c Cr

Particulars Particulars

To Share capital 1,00,000 By Balance b/d 2,00,000

To Balance c/d 1,00,000

2,00,000 2,00,000

The next step is to prepare the Adjusted Profit & Loss A/c.

Dr Adjusted Profit & Loss A/c Cr

Particulars Particulars

To (Fixed Assets ) depreciation 30,000 By Balance b/d (Retained Earnings) 60,000

To Balance c/d 1,20,000 By Fund from operation Balancing fig.. 90,000

1,50,000 1,50,000

The next step is to prepare the fund flow statement of the enterprise.

LOVELY PROFESSIONAL UNIVERSITY 151