Page 155 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 155

Accounting for Managers

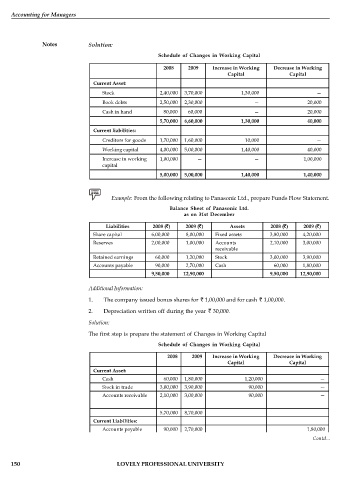

Notes Solution:

Schedule of Changes in Working Capital

2008 2009 Increase in Working Decrease in Working

Capital Capital

Current Asset:

Stock 2,40,000 3,70,000 1,30,000 —

Book debts 2,50,000 2,30,000 — 20,000

Cash in hand 80,000 60,000 — 20,000

5,70,000 6,60,000 1,30,000 40,000

Current liabilities:

Creditors for goods 1,70,000 1,60,000 10,000 —

Working capital 4,00,000 5,00,000 1,40,000 40,000

Increase in working 1,00,000 — — 1,00,000

capital

5,00,000 5,00,000 1,40,000 1,40,000

Example: From the following relating to Panasonic Ltd., prepare Funds Flow Statement.

Balance Sheet of Panasonic Ltd.

as on 31st December

Liabilities 2008 ( ) 2009 ( ) Assets 2008 ( ) 2009 ( )

Share capital 6,00,000 8,00,000 Fixed assets 3,80,000 4,20,000

Reserves 2,00,000 1,00,000 Accounts 2,10,000 3,00,000

receivable

Retained earnings 60,000 1,20,000 Stock 3,00,000 3,90,000

Accounts payable 90,000 2,70,000 Cash 60,000 1,80,000

9,50,000 12,90,000 9,50,000 12,90,000

Additional Information:

1. The company issued bonus shares for 1,00,000 and for cash 1,00,000.

2. Depreciation written off during the year 30,000.

Solution:

The first step is prepare the statement of Changes in Working Capital

Schedule of Changes in Working Capital

2008 2009 Increase in Working Decrease in Working

Capital Capital

Current Asset:

Cash 60,000 1,80,000 1,20,000 —

Stock in trade 3,00,000 3,90,000 90,000 —

Accounts receivable 2,10,000 3,00,000 90,000 —

5,70,000 8,70,000

Current Liabilities:

Accounts payable 90,000 2,70,000 1,80,000

Working capital 4,80,000 6,00,000 3,00,000 1,80,000

Contd...

Increase in working 1,20,000 1,20,000

capital

6,00,000 6,00,000 3,00,000 3,00,000

150 LOVELY PROFESSIONAL UNIVERSITY