Page 150 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 150

Unit 7: Fund Flow Statement

Important Adjustments Notes

1. Provision for tax: At the time of preparation of fund flow statement, there are two

approaches to treat this item. These are:

(i) Treat it as a current liability

(ii) Treat it as an appropriation of profit

As per first approach, the provision for taxation is assumed as a current liability. Therefore,

it must be shown in the schedule of working capital changes. All the information relating

taxation should be ignored as in the case of other current liabilities. In this approach, the

provision, for taxation is neither used in the fund from operation nor in the uses of fund in

the Fund Flow Statement as payment of tax liability.

Under second approach, the provision for taxation is treated as an appropriation of profit.

Provision for taxation is not shown in the Schedule of Working Capital Changes. As other

appropriations it is added back in the net profits to calculate the Fund from Operation. To

find the payment of tax of the year provision for taxation account is prepared. Payment of

the tax of the year is disclosed in the Uses of Fund in the Fund Flow Statement. Provision

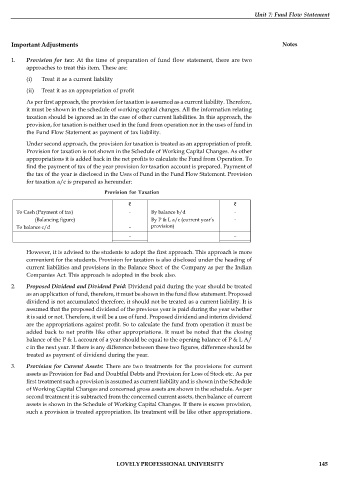

for taxation a/c is prepared as hereunder:

Provision for Taxation

To Cash (Payment of tax) - By balance b/d -

(Balancing figure) By P & L a/c (current year’s -

To balance c/d - provision)

– –

However, it is advised to the students to adopt the first approach. This approach is more

convenient for the students. Provision for taxation is also disclosed under the heading of

current liabilities and provisions in the Balance Sheet of the Company as per the Indian

Companies Act. This approach is adopted in the book also.

2. Proposed Dividend and Dividend Paid: Dividend paid during the year should be treated

as an application of fund, therefore, it must be shown in the fund flow statement. Proposed

dividend is not accumulated therefore, it should not be treated as a current liability. It is

assumed that the proposed dividend of the previous year is paid during the year whether

it is said or not. Therefore, it will be a use of fund. Proposed dividend and interim dividend

are the appropriations against profit. So to calculate the fund from operation it must be

added back to net profits like other appropriations. It must be noted that the closing

balance of the P & L account of a year should be equal to the opening balance of P & L A/

c in the next year. If there is any difference between these two figures, difference should be

treated as payment of dividend during the year.

3. Provision for Current Assets: There are two treatments for the provisions for current

assets as Provision for Bad and Doubtful Debts and Provision for Loss of Stock etc. As per

first treatment such a provision is assumed as current liability and is shown in the Schedule

of Working Capital Changes and concerned gross assets are shown in the schedule. As per

second treatment it is subtracted from the concerned current assets, then balance of current

assets is shown in the Schedule of Working Capital Changes. If there is excess provision,

such a provision is treated appropriation. Its treatment will be like other appropriations.

LOVELY PROFESSIONAL UNIVERSITY 145