Page 154 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 154

Unit 7: Fund Flow Statement

Less: Refund of Tax 6,000 Notes

Profit on Sale of Building 10,000

Dividend Received 10,000

Fund from Operations 96,000

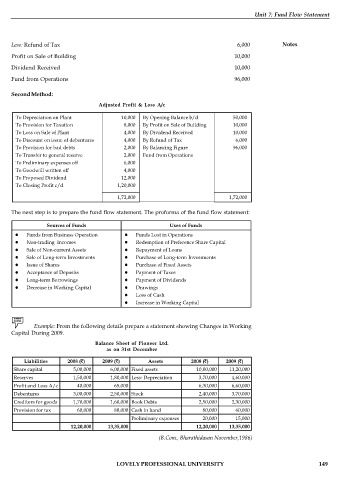

Second Method:

Adjusted Profit & Loss A/c

To Depreciation on Plant 10,000 By Opening Balance b/d 50,000

To Provision for Taxation 8,000 By Profit on Sale of Building 10,000

To Loss on Sale of Plant 4,000 By Dividend Received 10,000

To Discount on issue of debentures 4,000 By Refund of Tax 6,000

To Provision for bad debts 2,000 By Balancing Figure 96,000

To Transfer to general reserve 2,000 Fund from Operations

To Preliminary expenses off 6,000

To Goodwill written off 4,000

To Proposed Dividend 12,000

To Closing Profit c/d 1,20,000

1,72,000 1,72,000

The next step is to prepare the fund flow statement. The proforma of the fund flow statement:

Sources of Funds Uses of Funds

Funds from Business Operation Funds Lost in Operations

Non-trading Incomes Redemption of Preference Share Capital

Sale of Non-current Assets Repayment of Loans

Sale of Long-term Investments Purchase of Long-term Investments

Issue of Shares Purchase of Fixed Assets

Acceptance of Deposits Payment of Taxes

Long-term Borrowings Payment of Dividends

Decrease in Working Capital Drawings

Loss of Cash

Increase in Working Capital

Example: From the following details prepare a statement showing Changes in Working

Capital During 2009.

Balance Sheet of Pioneer Ltd.

as on 31st December

Liabilities 2008 ( ) 2009 ( ) Assets 2008 ( ) 2009 ( )

Share capital 5,00,000 6,00,000 Fixed assets 10,00,000 11,20,000

Reserves 1,50,000 1,80,000 Less: Depreciation 3,70,000 4,60,000

Profit and Loss A/c 40,000 65,000 6,30,000 6,60,000

Debentures 3,00,000 2,50,000 Stock 2,40,000 3,70,000

Creditors for goods 1,70,000 1,60,000 Book Debts 2,50,000 2,30,000

Provision for tax 60,000 80,000 Cash in hand 80,000 60,000

Preliminary expenses 20,000 15,000

12,20,000 13,35,000 12,20,000 13,35,000

(B.Com., Bharathidasan November,1986)

LOVELY PROFESSIONAL UNIVERSITY 149