Page 168 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 168

Cash Flow Statement Fund Flow Statement

Cash inflow and outflow are only considered Increase or decrease in the working capital is

registered

Causes & changes of cash position Causes & changes of working capital position

Unit 8: Cash Flow Statement

Considers only most liquid assets pertaining Considers in general i.e. current assets; the

to cash resource; which fosters only for very duration of the liquidity of the current assets

short span of planning are longer in gestation than the liquid assets;

which paves way for long span of planning

Opening and closing balances of cash Increase or decrease of working capital is Notes

resources are considered for the preparation considered but not the opening and closing

balance for preparation

The flow in the statement means real cash The flow in the statement need not be real cash

flow flow

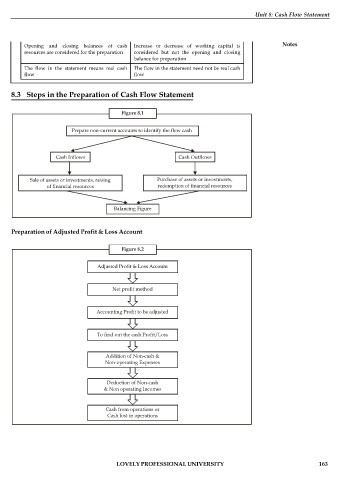

8.3 Steps in the Preparation of Cash Flow Statement

Figure 8.1

Prepare non-current accounts to identify the flow cash

Cash Inflows Cash Outflows

Sale of assets or investments, raising Purchase of assets or investments,

of financial resources redemption of financial resources

Balancing Figure

Preparation of Adjusted Profit & Loss Account

Figure 8.2

Adjusted Profit & Loss Account

Net profit method

Accounting Profit to be adjusted

To find out the cash Profit/Loss

Addition of Non-cash &

Non-operating Expenses

Deduction of Non-cash

& Non operating Incomes

Cash from operations or

Cash lost in operations

LOVELY PROFESSIONAL UNIVERSITY 163