Page 176 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 176

Unit 8: Cash Flow Statement

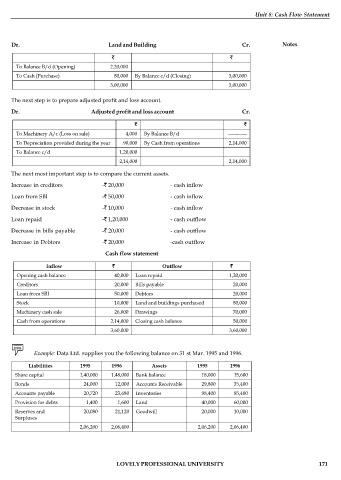

Dr. Land and Building Cr. Notes

To Balance B/d (Opening) 2,20,000

To Cash (Purchase) 80,000 By Balance c/d (Closing) 3,00,000

3,00,000 3,00,000

The next step is to prepare adjusted profit and loss account.

Dr. Adjusted profit and loss account Cr.

To Machinery A/c (Loss on sale) 4,000 By Balance B/d -----------

To Depreciation provided during the year 90,000 By Cash from operations 2,14,000

To Balance c/d 1,20,000

2,14,000 2,14,000

The next most important step is to compare the current assets.

Increase in creditors - 20,000 - cash inflow

Loan from SBI - 50,000 - cash inflow

Decrease in stock - 10,000 - cash inflow

Loan repaid - 1,20,000 - cash outflow

Decrease in bills payable - 20,000 - cash outflow

Increase in Debtors - 20,000 -cash outflow

Cash flow statement

Inflow Outflow

Opening cash balance 40,000 Loan repaid 1,20,000

Creditors 20,000 Bills payable 20,000

Loan from SBI 50,000 Debtors 20,000

Stock 10,000 Land and buildings purchased 80,000

Machinery cash sale 26,000 Drawings 70,000

Cash from operations 2,14,000 Closing cash balance 50,000

3,60,000 3,60,000

Example: Data Ltd. supplies you the following balance on 31 st Mar. 1995 and 1996.

Liabilities 1995 1996 Assets 1995 1996

Share capital 1,40,000 1,48,000 Bank balance 18,000 15,600

Bonds 24,000 12,000 Accounts Receivable 29,800 35,400

Accounts payable 20,720 23,680 Inventories 98,400 85,400

Provision for debts 1,400 1,600 Land 40,000 60,000

Reserves and 20,080 21,120 Goodwill 20,000 10,000

Surpluses

2,06,200 2,06,400 2,06,200 2,06,400

LOVELY PROFESSIONAL UNIVERSITY 171