Page 174 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 174

Unit 8: Cash Flow Statement

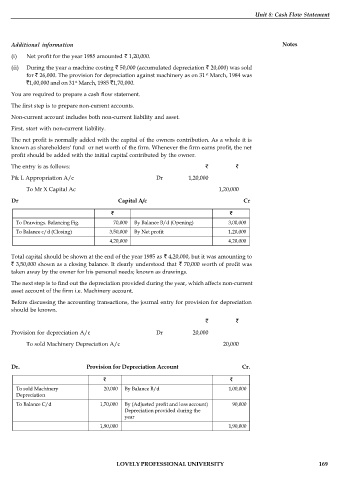

Additional information Notes

(i) Net profit for the year 1985 amounted 1,20,000.

(ii) During the year a machine costing 50,000 (accumulated depreciation 20,000) was sold

st

for 26,000. The provision for depreciation against machinery as on 31 March, 1984 was

1,00,000 and on 31 March, 1985 1,70,000.

st

You are required to prepare a cash flow statement.

The first step is to prepare non-current accounts.

Non-current account includes both non-current liability and asset.

First, start with non-current liability.

The net profit is normally added with the capital of the owners contribution. As a whole it is

known as shareholders' fund or net worth of the firm. Whenever the firm earns profit, the net

profit should be added with the initial capital contributed by the owner.

The entry is as follows:

P& L Appropriation A/c Dr 1,20,000

To Mr X Capital Ac 1,20,000

Dr Capital A/c Cr

To Drawings. Balancing Fig. 70,000 By Balance B/d (Opening) 3,00,000

To Balance c/d (Closing) 3,50,000 By Net profit 1,20,000

4,20,000 4,20,000

Total capital should be shown at the end of the year 1985 as 4,20,000, but it was amounting to

3,50,000 shown as a closing balance. It clearly understood that 70,000 worth of profit was

taken away by the owner for his personal needs; known as drawings.

The next step is to find out the depreciation provided during the year, which affects non-current

asset account of the firm i.e. Machinery account.

Before discussing the accounting transactions, the journal entry for provision for depreciation

should be known.

Provision for depreciation A/c Dr 20,000

To sold Machinery Depreciation A/c 20,000

Dr. Provision for Depreciation Account Cr.

To sold Machinery 20,000 By Balance B/d 1,00,000

Depreciation

To Balance C/d 1,70,000 By (Adjusted profit and loss account) 90,000

Depreciation provided during the

year

1,90,000 1,90,000

LOVELY PROFESSIONAL UNIVERSITY 169