Page 74 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 74

Unit 4: Final Accounts

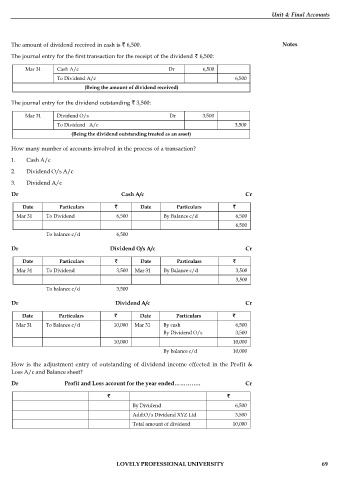

The amount of dividend received in cash is 6,500. Notes

The journal entry for the first transaction for the receipt of the dividend 6,500:

Mar 31 Cash A/c Dr 6,500

To Dividend A/c 6,500

(Being the amount of dividend received)

The journal entry for the dividend outstanding 3,500:

Mar 31 Dividend O/s Dr 3,500

To Dividend A/c 3,500

(Being the dividend outstanding treated as an asset)

How many number of accounts involved in the process of a transaction?

1. Cash A/c

2. Dividend O/s A/c

3. Dividend A/c

Dr Cash A/c Cr

Date Particulars Date Particulars

Mar 31 To Dividend 6,500 By Balance c/d 6,500

6,500

To balance c/d 6,500

Dr Dividend O/s A/c Cr

Date Particulars Date Particulars

Mar 31 To Dividend 3,500 Mar 31 By Balance c/d 3,500

3,500

To balance c/d 3,500

Dr Dividend A/c Cr

Date Particulars Date Particulars

Mar 31 To Balance c/d 10,000 Mar 31 By cash 6,500

By Dividend O/s 3,500

10,000 10,000

By balance c/d 10,000

How is the adjustment entry of outstanding of dividend income effected in the Profit &

Loss A/c and Balance sheet?

Dr Profit and Loss account for the year ended………….. Cr

By Dividend 6,500

Add:O/s Dividend XYZ Ltd 3,500

Total amount of dividend 10,000

LOVELY PROFESSIONAL UNIVERSITY 69