Page 76 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 76

Unit 4: Final Accounts

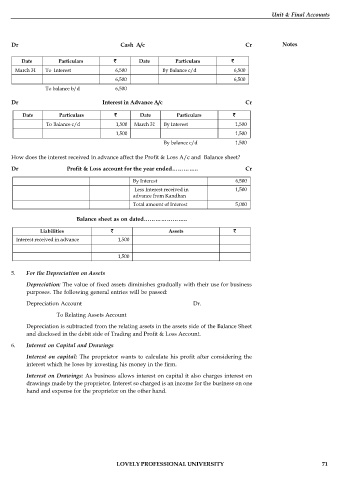

Dr Cash A/c Cr Notes

Date Particulars Date Particulars

March 31 To Interest 6,500 By Balance c/d 6,500

6,500 6,500

To balance b/d 6,500

Dr Interest in Advance A/c Cr

Date Particulars Date Particulars

To Balance c/d 1,500 March 31 By Interest 1,500

1,500 1,500

By balance c/d 1,500

How does the interest received in advance affect the Profit & Loss A/c and Balance sheet?

Dr Profit & Loss account for the year ended………….. Cr

By Interest 6,500

Less Interest received in 1,500

advance from Kandhan

Total amount of Interest 5,000

Balance sheet as on dated…………………..

Liabilities Assets

Interest received in advance 1,500

1,500

5. For the Depreciation on Assets

Depreciation: The value of fixed assets diminishes gradually with their use for business

purposes. The following general entries will be passed:

Depreciation Account Dr.

To Relating Assets Account

Depreciation is subtracted from the relating assets in the assets side of the Balance Sheet

and disclosed in the debit side of Trading and Profit & Loss Account.

6. Interest on Capital and Drawings

Interest on capital: The proprietor wants to calculate his profit after considering the

interest which he loses by investing his money in the firm.

Interest on Drawings: As business allows interest on capital it also charges interest on

drawings made by the proprietor. Interest so charged is an income for the business on one

hand and expense for the proprietor on the other hand.

LOVELY PROFESSIONAL UNIVERSITY 71