Page 80 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 80

Unit 4: Final Accounts

Notes

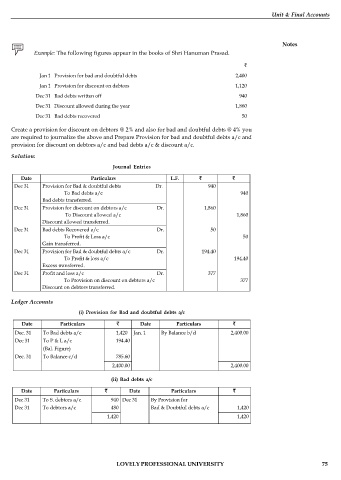

Example: The following figures appear in the books of Shri Hanuman Prasad.

Jan 1 Provision for bad and doubtful debts 2,400

Jan 1 Provision for discount on debtors 1,120

Dec 31 Bad debts written off 940

Dec 31 Discount allowed during the year 1,860

Dec 31 Bad debts recovered 50

Dec 31 Debtors Write off further Rs. 480 (definitely bad) 20,120

Create a provision for discount on debtors @ 2% and also for bad and doubtful debts @ 4% you

are required to journalize the above and Prepare Provision for bad and doubtful debts a/c and

provision for discount on debtors a/c and bad debts a/c & discount a/c.

Solution:

Journal Entries

Date Particulars L.F.

Dec 31 Provision for Bad & doubtful debts Dr. 940

To Bad debts a/c 940

Bad debts transferred.

Dec 31 Provision for discount on debtors a/c Dr. 1,860

To Discount allowed a/c 1,860

Discount allowed transferred.

Dec 31 Bad debts Recovered a/c Dr. 50

To Profit & Loss a/c 50

Gain transferred.

Dec 31 Provision for Bad & doubtful debts a/c Dr. 194.40

To Profit & loss a/c 194.40

Excess transferred.

Dec 31 Profit and loss a/c Dr. 377

To Provision on discount on debtors a/c 377

Discount on debtors transferred.

Ledger Accounts

(i) Provision for Bad and doubtful debts a/c

Date Particulars Date Particulars

Dec. 31 To Bad debts a/c 1,420 Jan. 1 By Balance b/d 2,400.00

Dec 31 To P & L a/c 194.40

(Bal. Figure)

Dec. 31 To Balance c/d 785.60

2,400.00 2,400.00

(ii) Bad debts a/c

Date Particulars Date Particulars

Dec 31 To S. debtors a/c 940 Dec 31 By Provision for

Dec 31 To debtors a/c 480 Bad & Doubtful debts a/c 1,420

1,420 1,420

LOVELY PROFESSIONAL UNIVERSITY 75