Page 83 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 83

Credit Balances

Debit Balances

Drawings

90,000

41,400

Goodwill

Bills Payable

Land and Building

1,80,000

91,500

Sundry Creditors

Plant and Machinery

7,950

Purchase Returns

1,20,000

3,45,000

9,000

Sales

Loose tools

6,000

Bills Receivable

1,20,000

Stock 1.1.2009

Purchase

1,53,000

Wages

60,000

3,600

Carriage Inwards 45,000 Capital Account 6,09,000

Carriage Outwards 4,500

Coal and Gas 16,800

Salaries 12,000

Accounting for Managers Rent, Rates and Taxes 8,400

Discount allowed 4,500

Cash at Bank 75,000

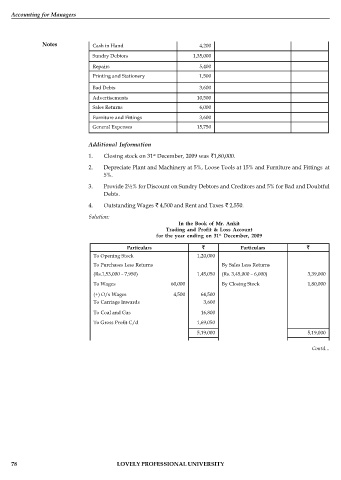

Notes Cash in Hand 4,200

Sundry Debtors 1,35,000

Repairs 5,400

Printing and Stationery 1,500

Bad Debts 3,600

Advertisements 10,500

Sales Returns 6,000

Furniture and Fittings 3,600

General Expenses 15,750

Additional Information

st

1. Closing stock on 31 December, 2009 was 1,80,000.

2. Depreciate Plant and Machinery at 5%, Loose Tools at 15% and Furniture and Fittings at

5%.

3. Provide 2½% for Discount on Sundry Debtors and Creditors and 5% for Bad and Doubtful

Debts.

4. Outstanding Wages 4,500 and Rent and Taxes 2,550.

Solution:

In the Book of Mr. Ankit

Trading and Profit & Loss Account

for the year ending on 31 December, 2009

st

Particulars Particulars

To Opening Stock 1,20,000

To Purchases Less Returns By Sales Less Returns

(Rs.1,53,000 – 7,950) 1,45,050 (Rs. 3,45,000 – 6,000) 3,39,000

To Wages 60,000 By Closing Stock 1,80,000

(+) O/s Wages 4,500 64,500

To Carriage Inwards 3,600

To Coal and Gas 16,800

To Gross Profit C/d 1,69,050

5,19,000 5,19,000

To Carriage Outwards 4,500 Contd...

To Salaries 12,000 By Gross Profit b/d 1,69,050

To Rent, Rates & Taxes 8,400 By Reserve for Discount on 2,250

Creditors @2 ½ %

(+) Outstanding 2,550 10,950

To Discount Allowed 4,500

To Repairs 5,400

To Printing & Stationary 1,500

To Bad Debts 3,600

(+) New Provision (D/D) 6,750

10,350

(+) Provision for Discount 3,206 13,556

To Advertisement 10,500

78 LOVELY PROFESSIONAL UNIVERSITY

To General Expenses 15,750

To Depreciation on:

Plant & Machinery 6,000

Loose tools 1,350

Furniture & Fittings 180 7,530

To Net Profit (transferred to Capital 85,114

A/c)

1,71,300 1,71,300