Page 81 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 81

Accounting for Managers

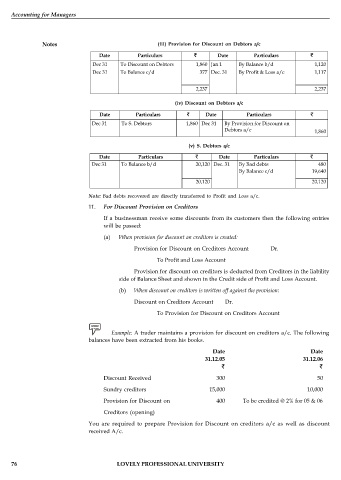

Notes (iii) Provision for Discount on Debtors a/c

Date Particulars Date Particulars

Dec 31 To Discount on Debtors 1,860 Jan 1 By Balance b/d 1,120

Dec 31 To Balance c/d 377 Dec. 31 By Profit & Loss a/c 1,117

2,237 2,237

(iv) Discount on Debtors a/c

Date Particulars Date Particulars

Dec 31 To S. Debtors 1,860 Dec 31 By Provision for Discount on

Debtors a/c 1,860

(v) S. Debtors a/c

Date Particulars Date Particulars

Dec 31 To Balance b/d 20,120 Dec. 31 By Bad debts 480

By Balance c/d 19,640

20,120 20,120

Note: Bad debts recovered are directly transferred to Profit and Loss a/c.

11. For Discount Provision on Creditors

If a businessman receive some discounts from its customers then the following entries

will be passed:

(a) When provision for discount on creditors is created:

Provision for Discount on Creditors Account Dr.

To Profit and Loss Account

Provision for discount on creditors is deducted from Creditors in the liability

side of Balance Sheet and shown in the Credit side of Profit and Loss Account.

(b) When discount on creditors is written off against the provision:

Discount on Creditors Account Dr.

To Provision for Discount on Creditors Account

Example: A trader maintains a provision for discount on creditors a/c. The following

balances have been extracted from his books.

Date Date

31.12.05 31.12.06

Discount Received 300 50

Sundry creditors 15,000 10,000

Provision for Discount on 400 To be credited @ 2% for 05 & 06

Creditors (opening)

You are required to prepare Provision for Discount on creditors a/c as well as discount

received A/c.

76 LOVELY PROFESSIONAL UNIVERSITY