Page 92 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 92

Particulars

Opening stock

30,000

Purchases

1,10,000

2,50,000

Sales

55,000

Building

Wages

23,000

3,000

Carriage inwards Debit ( ) Credit ( )

Bills payable 10,000

Furniture 9000

Salaries 42,000

Advertisement 24,000

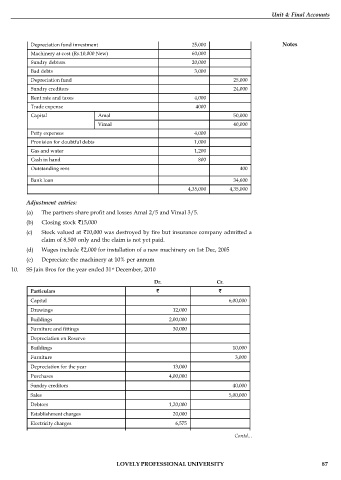

Unit 4: Final Accounts

Coal and coke 2,000

Cash at bank 14,000

Pre-paid wages 1,000

Depreciation fund investment 25,000 Notes

Machinery at cost (Rs.10,000 New) 60,000

Sundry debtors 20,000

Bad debts 3,000

Depreciation fund 25,000

Sundry creditors 24,000

Rent rate and taxes 4,000

Trade expense 4000

Capital Amal 50,000

Vimal 40,000

Petty expenses 4,000

Provision for doubtful debts 1,000

Gas and water 1,200

Cash in hand 800

Outstanding rent 400

Bank loan 34,600

4,35,000 4,35,000

Adjustment entries:

(a) The partners share profit and losses Amal 2/5 and Vimal 3/5.

(b) Closing stock 15,000

(c) Stock valued at 10,000 was destroyed by fire but insurance company admitted a

claim of 8,500 only and the claim is not yet paid.

(d) Wages include 2,000 for installation of a new machinery on 1st Dec, 2005

(e) Depreciate the machinery at 10% per annum

10. SS Jain Bros for the year ended 31 December, 2010

st

Dr. Cr.

Particulars

Capital 6,00,000

Drawings 12,000

Buildings 2,00,000

Furniture and fittings 30,000

Depreciation on Reserve

Buildings 10,000

Furniture 3,000

Depreciation for the year 13,000

Purchases 4,00,000

Sundry creditors 40,000

Sales 5,00,000

Debtors 1,20,000

Establishment charges 20,000

Electricity charges 6,575

Postage and telegram 1,284

Contd...

Travelling and conveyance 3,816

Advance for sales commission 1,000

Insurance 2,500

LOVELY PROFESSIONAL UNIVERSITY 87

Rent received 12,000

Motor van (purchased 1.1.03) 80,000

Motor van maintenance 23,425

Fixed deposit (1.9.2003) 1,00,000

Cash in hand 1,823

Cash at bank 1,47,977