Page 96 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 96

Unit 5: Basic Cost Concepts

5.1 Meaning of Cost Accounting Notes

It is the process of classifying, recording and appropriate allocation of expenditure for the

determination of costs of products or services through the presentation of data for the purpose

to take decisions and guide the business organization.

The following table explains the differences between the cost accounting and management

accounting:

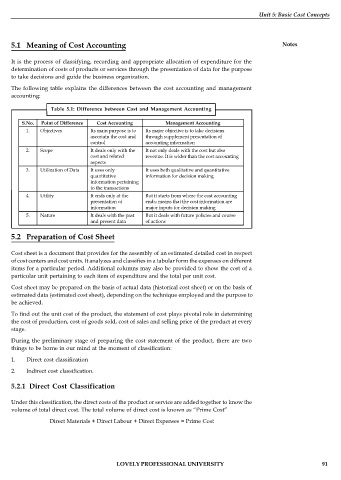

Table 5.1: Difference between Cost and Management Accounting

S.No. Point of Difference Cost Accounting Management Accounting

1. Objectives Its main purpose is to Its major objective is to take decisions

ascertain the cost and through supplement presentation of

control accounting information

2. Scope It deals only with the It not only deals with the cost but also

cost and related revenue. It is wider than the cost accounting

aspects

3. Utilization of Data It uses only It uses both qualitative and quantitative

quantitative information for decision making

information pertaining

to the transactions

4. Utility It ends only at the But it starts from where the cost accounting

presentation of ends; means that the cost information are

information major inputs for decision making

5. Nature It deals with the past But it deals with future policies and course

and present data of actions

5.2 Preparation of Cost Sheet

Cost sheet is a document that provides for the assembly of an estimated detailed cost in respect

of cost centers and cost units. It analyzes and classifies in a tabular form the expenses on different

items for a particular period. Additional columns may also be provided to show the cost of a

particular unit pertaining to each item of expenditure and the total per unit cost.

Cost sheet may be prepared on the basis of actual data (historical cost sheet) or on the basis of

estimated data (estimated cost sheet), depending on the technique employed and the purpose to

be achieved.

To find out the unit cost of the product, the statement of cost plays pivotal role in determining

the cost of production, cost of goods sold, cost of sales and selling price of the product at every

stage.

During the preliminary stage of preparing the cost statement of the product, there are two

things to be borne in our mind at the moment of classification:

1. Direct cost classification

2. Indirect cost classification.

5.2.1 Direct Cost Classification

Under this classification, the direct costs of the product or service are added together to know the

volume of total direct cost. The total volume of direct cost is known as “Prime Cost”

Direct Materials + Direct Labour + Direct Expenses = Prime Cost

LOVELY PROFESSIONAL UNIVERSITY 91