Page 101 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 101

Accounting for Managers

Notes

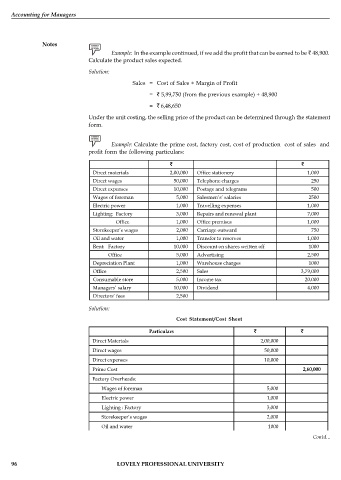

Example: In the example continued, if we add the profit that can be earned to be 48,900.

Calculate the product sales expected.

Solution:

Sales = Cost of Sales + Margin of Profit

= 5,99,750 (from the previous example) + 48,900

= 6,48,650

Under the unit costing, the selling price of the product can be determined through the statement

form.

Example: Calculate the prime cost, factory cost, cost of production cost of sales and

profit form the following particulars:

Direct materials 2,00,000 Office stationery 1,000

Direct wages 50,000 Telephone charges 250

Direct expenses 10,000 Postage and telegrams 500

Wages of foreman 5,000 Salesmen’s’ salaries 2500

Electric power 1,000 Travelling expenses 1,000

Lighting: Factory 3,000 Repairs and renewal plant 7,000

Office 1,000 Office premises 1,000

Storekeeper’s wages 2,000 Carriage outward 750

Oil and water 1,000 Transfer to reserves 1,000

Rent: Factory 10,000 Discount on shares written off 1000

Office 5,000 Advertising 2,500

Depreciation Plant 1,000 Warehouse charges 1000

Office 2,500 Sales 3,79,000

Consumable store 5,000 Income tax 20,000

Managers’ salary 10,000 Dividend 4,000

Directors’ fees 2,500

Solution:

Cost Statement/Cost Sheet

Particulars

Direct Materials 2,00,000

Direct wages 50,000

Direct expenses 10,000

2,60,000

Prime Cost

Factory Overheads:

Wages of foreman 5,000

Electric power 1,000

Lighting : Factory 3,000

Storekeeper’s wages 2,000

Oil and water 1000

Rent: Factory 10,000 Contd...

Depreciation Plant 1000

Consumable store 5,000

LOVELY PROFESSIONAL UNIVERSITY

96 Repairs and Renewal Plant 7,000 35,000

Factory Cost

2,95,000

Administration Overheads:

Rent Office 5,000

Depreciation office 2,500

Managers’ salary 10,000

Directors’ fees 2,500

Office stationery 1,000

Telephone charges 250

Postage and telegrams 500

Office premises 1,000

Lighting: Office 1,000 23,750

Cost of production 3,18,750

Selling and distribution overheads:

Carriage outward 750

Salesmen’s salaries 2500

Travelling expenses 1,000

Advertising 2500

Warehouse charges 1000

7,750

Cost of Sales 3,26,500

Profit 52,500

Sales 3,79,000