Page 99 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 99

Accounting for Managers

Office Rent 6,000

Office Lighting 1,250

Office Depreciation 3,500

Notes Director's Fees 2,500

Manager's Salary 10,000

Office Stationery 1,000

Telephone Charges 500

Postage and Telegrams 250

Solution:

Production Cost = Factory Cost + Administrative Cost

Factory Cost = 5,58,000 (from the previous example)

Administrative Cost = Office Rent + Office Lighting + Office Depreciation + Director’s Fees

+ Manager’s Salary + Office Stationery + Telephone Charges + Postage

and Telegrams

= 6,000 + 1,250 + 3,500 + 2,500 + 10,000 + 1,000 + 500 + 250

= 25,000

Hence,Production Cost = 5,58,000 + 25,000

= 5,83,000

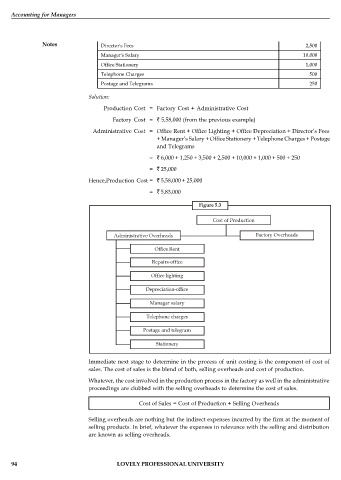

Figure 5.3

Cost of Production

Administrative Overheads Factory Overheads

Office Rent

Repairs-office

Office lighting

Depreciation-office

Manager salary

Telephone charges

Postage and telegram

Stationery

Immediate next stage to determine in the process of unit costing is the component of cost of

sales. The cost of sales is the blend of both, selling overheads and cost of production.

Whatever, the cost involved in the production process in the factory as well in the administrative

proceedings are clubbed with the selling overheads to determine the cost of sales.

Cost of Sales = Cost of Production + Selling Overheads

Selling overheads are nothing but the indirect expenses incurred by the firm at the moment of

selling products. In brief, whatever the expenses in relevance with the selling and distribution

are known as selling overheads.

94 LOVELY PROFESSIONAL UNIVERSITY