Page 296 - DMGT516_LABOUR_LEGISLATIONS

P. 296

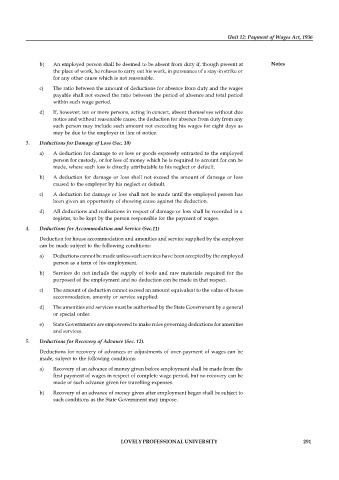

Unit 12: Payment of Wages Act, 1936

b) An employed person shall be deemed to be absent from duty if, though present at Notes

the place of work, he refuses to carry out his work, in pursuance of a stay-in strike or

for any other cause which is not reasonable.

c) The ratio between the amount of deductions for absence from duty and the wages

payable shall not exceed the ratio between the period of absence and total period

within such wage period.

d) If, however, ten or more persons, acting in concert, absent themselves without due

notice and without reasonable cause, the deduction for absence from duty from any

such person may include such amount not exceeding his wages for eight days as

may be due to the employer in lieu of notice.

3. Deductions for Damage of Loss (Sec. 10)

a) A deduction for damage to or loss or goods expressly entrusted to the employed

person for custody, or for loss of money which he is required to account for can be

made, where such loss is directly attributable to his neglect or default.

b) A deduction for damage or loss shall not exceed the amount of damage or loss

caused to the employer by his neglect or default.

c) A deduction for damage or loss shall not be made until the employed person has

been given an opportunity of showing cause against the deduction.

d) All deductions and realisations in respect of damage or loss shall be recorded in a

register, to be kept by the person responsible for the payment of wages.

4. Deductions for Accommodation and Service (Sec.11)

Deduction for house accommodation and amenities and service supplied by the employer

can be made subject to the following conditions:

a) Deductions cannot be made unless such services have been accepted by the employed

person as a term of his employment.

b) Services do not include the supply of tools and raw materials required for the

purposed of the employment and no deduction can be made in that respect.

c) The amount of deduction cannot exceed an amount equivalent to the value of house

accommodation, amenity or service supplied.

d) The amenities and services must be authorised by the State Government by a general

or special order.

e) State Governments are empowered to make rules governing deductions for amenities

and services.

5. Deductions for Recovery of Advance (Sec. 12).

Deductions for recovery of advances or adjustments of over-payment of wages can be

made, subject to the following conditions:

a) Recovery of an advance of money given before employment shall be made from the

first payment of wages in respect of complete wage period, but no recovery can be

made of such advance given for travelling expenses.

b) Recovery of an advance of money given after employment began shall be subject to

such conditions as the State Government may impose.

LOVELY PROFESSIONAL UNIVERSITY 291