Page 293 - DMGT516_LABOUR_LEGISLATIONS

P. 293

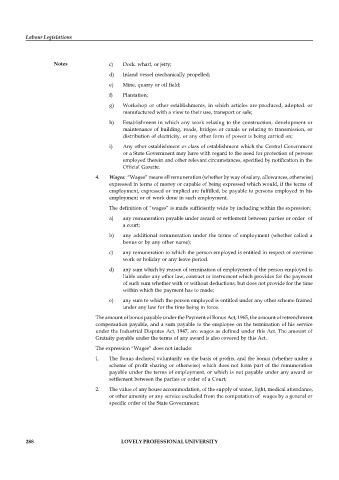

Labour Legislations

Notes c) Dock. wharf, or jetty;

d) Inland vessel mechanically propelled;

e) Mine, quarry or oil field;

f) Plantation;

g) Workshop or other establishments, in which articles are produced, adopted. or

manufactured with a view to their use, transport or sale;

h) Establishment in which any work relating to the construction, development or

maintenance of building, roads, bridges or canals or relating to transmission, or

distribution of electricity, or any other form of power is being carried on;

i) Any other establishment or class of establishment which the Central Government

or a State Government may have with regard to the need for protection of persons

employed therein and other relevant circumstances, specified by notification in the

Official Gazette.

4. Wages: “Wages” means all remuneration (whether by way of salary, allowances, otherwise)

expressed in terms of money or capable of being expressed which would, if the terms of

employment, expressed or implied are fulfilled, be payable to persons employed in his

employment or of work done in such employment.

The definition of “wages” is made sufficiently wide by including within the expression:

a) any remuneration payable under award or settlement between parties or order of

a court;

b) any additional remuneration under the terms of employment (whether called a

bonus or by any other name);

c) any remuneration to which the person employed is entitled in respect of overtime

work or holiday or any leave period.

d) any sum which by reason of termination of employment of the person employed is

liable under any other law, contract or instrument which provides for the payment

of such sum whether with or without deductions, but does not provide for the time

within which the payment has to made;

e) any sum to which the person employed is entitled under any other scheme framed

under any law for the time being in force.

The amount of bonus payable under the Payment of Bonus Act, 1965, the amount of retrenchment

compensation payable, and a sum payable to the employee on the termination of his service

under the Industrial Disputes Act, 1947, are wages as defined under this Act. The amount of

Gratuity payable under the terms of any award is also covered by this Act.

The expression “Wages” does not include:

1. The Bonus declared voluntarily on the basis of profits, and the bonus (whether under a

scheme of profit sharing or otherwise) which does not form part of the remuneration

payable under the terms of employment, or which is not payable under any award or

settlement between the parties or order of a Court;

2. The value of any house accommodation, of the supply of water, light, medical attendance,

or other amenity or any service excluded from the computation of wages by a general or

specific order of the State Government;

288 LOVELY PROFESSIONAL UNIVERSITY