Page 297 - DMGT516_LABOUR_LEGISLATIONS

P. 297

Labour Legislations

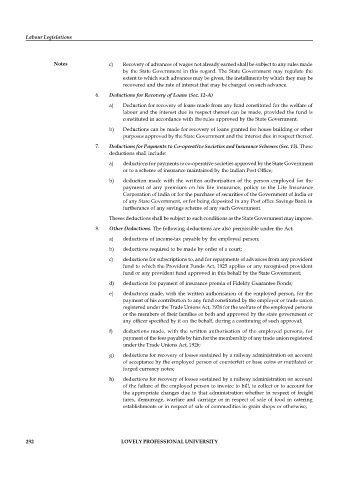

Notes c) Recovery of advances of wages not already earned shall be subject to any rules made

by the State Government in this regard. The State Government may regulate the

extent to which such advances may be given, the installments by which they may be

recovered and the rate of interest that may be charged on such advance.

6. Deductions for Recovery of Loans (Sec. 12-A)

a) Deduction for recovery of loans made from any fund constituted for the welfare of

labour and the interest due in respect thereof can be made, provided the fund is

constituted in accordance with the rules approved by the State Government.

b) Deductions can be made for recovery of loans granted for house building or other

purposes approved by the State Government and the interest due in respect thereof.

7. Deductions for Payments to Co-operative Societies and Insurance Schemes (Sec. 13). These

deductions shall include:

a) deductions for payments to co-operative societies approved by the State Government

or to a scheme of insurance maintained by the Indian Post Office;

b) deduction made with the written authorisation of the person employed for the

payment of any premium on his life insurance, policy to the Life Insurance

Corporation of India or for the purchase of securities of the Government of India or

of any State Government, or for being deposited in any Post office Savings Bank in

furtherance of any savings scheme of any such Government.

Theses deductions shall be subject to such conditions as the State Government may impose.

8. Other Deductions. The following deductions are also permissible under the Act:

a) deductions of income-tax payable by the employed person;

b) deductions required to be made by order of a court;

c) deductions for subscriptions to, and for repayments of advances from any provident

fund to which the Provident Funds Act, 1925 applies or any recognised provident

fund or any provident fund approved in this behalf by the State Government;

d) deductions for payment of insurance premia of Fidelity Guarantee Bonds;

e) deductions made, with the written authorisation of the employed person, for the

payment of his contribution to any fund constituted by the employer or trade union

registered under the Trade Unions Act, 1926 for the welfare of the employed persons

or the members of their families or both and approved by the state government or

any officer specified by it on the behalf, during a continuing of such approval;

f) deductions made, with the written authorisation of the employed persons, for

payment of the fees payable by him for the membership of any trade union registered

under the Trade Unions Act, 1926;

g) deductions for recovery of losses sustained by a railway administration on account

of acceptance by the employed person of counterfeit or base coins or mutilated or

forged currency notes;

h) deductions for recovery of losses sustained by a railway administration on account

of the failure of the employed person to invoice to bill, to collect or to account for

the appropriate changes due to that administration whether in respect of freight

fares, demurrage, warfare and carriage or in respect of sale of food in catering

establishments or in respect of sale of commodities in grain shops or otherwise;

292 LOVELY PROFESSIONAL UNIVERSITY