Page 306 - DMGT516_LABOUR_LEGISLATIONS

P. 306

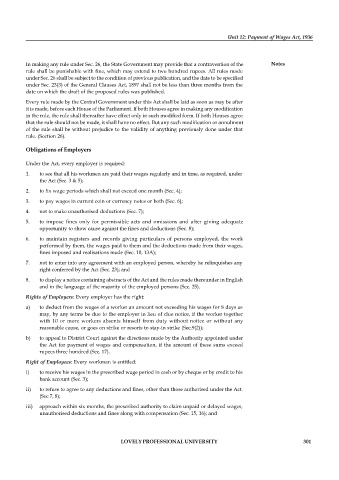

Unit 12: Payment of Wages Act, 1936

In making any rule under Sec. 26, the State Government may provide that a contravention of the Notes

rule shall be punishable with fine, which may extend to two hundred rupees. All rules made

under Sec. 26 shall be subject to the condition of previous publication, and the date to be specified

under Sec. 23(3) of the General Clauses Act, 1897 shall not be less than three months from the

date on which the draft of the proposed rules was published.

Every rule made by the Central Government under this Act shall be laid as soon as may be after

it is made, before each House of the Parliament. If both Houses agree in making any modification

in the rule, the rule shall thereafter have effect only in such modified form. If both Houses agree

that the rule should not be made, it shall have no effect. But any such modification or annulment

of the rule shall be without prejudice to the validity of anything previously done under that

rule. (Section 26).

Obligations of Employers

Under the Act, every employer is required:

1. to see that all his workmen are paid their wages regularly and in time, as required, under

the Act (Sec. 3 & 5);

2. to fix wage periods which shall not exceed one month (Sec. 4);

3. to pay wages in current coin or currency notes or both (Sec. 6);

4. not to make unauthorised deductions (Sec. 7);

5. to impose fines only for permissible acts and omissions and after giving adequate

opportunity to show cause against the fines and deductions (Sec. 8);

6. to maintain registers and records giving particulars of persons employed, the work

performed by them, the wages paid to them and the deductions made from their wages,

fines imposed and realisations made (Sec. 10, 13A);

7. not to enter into any agreement with an employed person, whereby he relinquishes any

right conferred by the Act (Sec. 23); and

8. to display a notice containing abstracts of the Act and the rules made thereunder in English

and in the language of the majority of the employed persons (Sec. 25).

Rights of Employers: Every employer has the right:

a) to deduct from the wages of a worker an amount not exceeding his wages for 8 days as

may, by any terms be due to the employer in lieu of clue notice, if the worker together

with 10 or more workers absents himself from duty without notice or without any

reasonable cause, or goes on strike or resorts to stay-in strike (Sec.9(2));

b) to appeal to District Court against the directions made by the Authority appointed under

the Act for payment of wages and compensation, if the amount of these sums exceed

rupees three hundred (Sec. 17).

Right of Employees: Every workman is entitled:

i) to receive his wages in the prescribed wage period in cash or by cheque or by credit to his

bank account (Sec. 3);

ii) to refuse to agree to any deductions and fines, other than those authorised under the Act.

(Sec 7, 8);

iii) approach within six months, the prescribed authority to claim unpaid or delayed wages,

unauthorised deductions and fines along with compensation (Sec. 15, 16); and

LOVELY PROFESSIONAL UNIVERSITY 301