Page 310 - DMGT516_LABOUR_LEGISLATIONS

P. 310

Unit 12: Payment of Wages Act, 1936

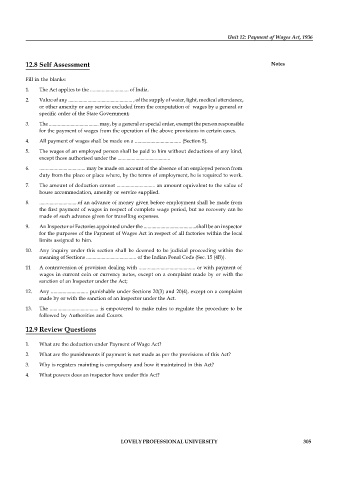

12.8 Self Assessment Notes

Fill in the blanks:

1. The Act applies to the .............................. of India.

2. Value of any .................................................. , of the supply of water, light, medical attendance,

or other amenity or any service excluded from the computation of wages by a general or

specific order of the State Government;

3. The ....................................... may, by a general or special order, exempt the person responsible

for the payment of wages from the operation of the above provisions in certain cases.

4. All payment of wages shall be made on a .................................... (Section 5).

5. The wages of an employed person shall be paid to him without deductions of any kind,

except those authorised under the .........................................

6. .................................... may be made on account of the absence of an employed person from

duty from the place or place where, by the terms of employment, he is required to work.

7. The amount of deduction cannot .............................. an amount equivalent to the value of

house accommodation, amenity or service supplied.

8. ..............................of an advance of money given before employment shall be made from

the first payment of wages in respect of complete wage period, but no recovery can be

made of such advance given for travelling expenses.

9. An Inspector of Factories appointed under the .........................................shall be an inspector

for the purposes of the Payment of Wages Act in respect of all factories within the local

limits assigned to him.

10. Any inquiry under this section shall be deemed to be judicial proceeding within the

meaning of Sections ....................................... of the Indian Penal Code (Sec. 15 (4B)).

11 A contravention of provision dealing with ............................................ or with payment of

wages in current coin or currency notes, except on a complaint made by or with the

sanction of an Inspector under the Act;

12. Any ............................. punishable under Sections 20(3) and 20(4), except on a complaint

made by or with the sanction of an Inspector under the Act.

13. The ...................................... is empowered to make rules to regulate the procedure to be

followed by Authorities and Courts.

12.9 Review Questions

1. What are the deduction under Payment of Wage Act?

2. What are the punishments if payment is not made as per the provisions of this Act?

3. Why is registers mainting is compulsory and how it maintained in this Act?

4. What powers does an inspector have under this Act?

LOVELY PROFESSIONAL UNIVERSITY 305