Page 265 - DMGT510_SERVICES_MARKETING

P. 265

Services Marketing

Notes Cost controls

Production capabilities and capacities

Management expertise and depth, etc.

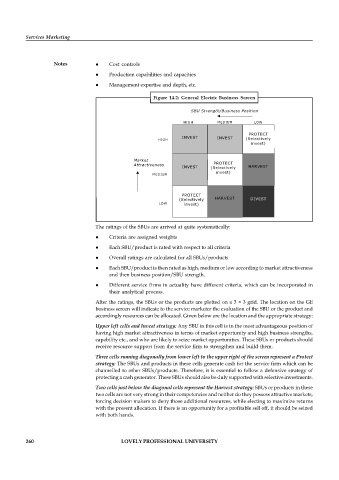

Figure 14.2: General Electric Business Screen

SBU Strength/Business Position

HIGH MEDIUM LOW

PROTECT

INVEST INVEST

HIGH (Selectively

invest)

Market

Attractiveness PROTECT

INVEST (Selectively HARVEST

invest)

MEDIUM

PROTECT

(Selectively HARVEST DIVEST

LOW invest)

The ratings of the SBUs are arrived at quite systematically:

Criteria are assigned weights

Each SBU/product is rated with respect to all criteria

Overall ratings are calculated for all SBUs/products

Each SBU/product is then rated as high, medium or low according to market attractiveness

and then business position/SBU strength.

Different service firms in actuality have different criteria, which can be incorporated in

their analytical process.

After the ratings, the SBUs or the products are plotted on a 3 × 3 grid. The location on the GE

business screen will indicate to the service marketer the evaluation of the SBU or the product and

accordingly resources can be allocated. Given below are the location and the appropriate strategy:

Upper left cells and Invest strategy: Any SBU in this cell is in the most advantageous position of

having high market attractiveness in terms of market opportunity and high business strengths,

capability etc., and who are likely to seize market opportunities. These SBUs or products should

receive resource support from the service firm to strengthen and build them.

Three cells running diagonally from lower left to the upper right of the screen represent a Protect

strategy: The SBUs and products in these cells generate cash for the service firm which can be

channelled to other SBUs/products. Therefore, it is essential to follow a defensive strategy of

protecting a cash generator. These SBUs should also be duly supported with selective investments.

Two cells just below the diagonal cells represent the Harvest strategy: SBUs or products in these

two cells are not very strong in their competencies and neither do they possess attractive markets,

forcing decision makers to deny those additional resources, while electing to maximize returns

with the present allocation. If there is an opportunity for a profitable sell off, it should be seized

with both hands.

260 LOVELY PROFESSIONAL UNIVERSITY