Page 46 - DMGT513_DERIVATIVES_AND_RISK_MANAGEMENT

P. 46

Unit 4: Future Contracts

Notes

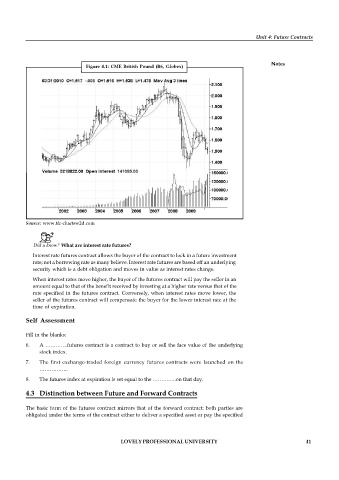

Figure 4.1: CME British Pound (B6, Globex)

Source: www.tfc-chartsw2d.com

Did u know? What are interest rate futures?

Interest rate futures contract allows the buyer of the contract to lock in a future investment

rate; not a borrowing rate as many believe. Interest rate futures are based off an underlying

security which is a debt obligation and moves in value as interest rates change.

When interest rates move higher, the buyer of the futures contract will pay the seller in an

amount equal to that of the benefit received by investing at a higher rate versus that of the

rate specified in the futures contract. Conversely, when interest rates move lower, the

seller of the futures contract will compensate the buyer for the lower interest rate at the

time of expiration.

Self Assessment

Fill in the blanks:

6. A ………….futures contract is a contract to buy or sell the face value of the underlying

stock index.

7. The first exchange-traded foreign currency futures contracts were launched on the

……………..

8. The futures index at expiration is set equal to the …………..on that day.

4.3 Distinction between Future and Forward Contracts

The basic form of the futures contract mirrors that of the forward contract: both parties are

obligated under the terms of the contract either to deliver a specified asset or pay the specified

LOVELY PROFESSIONAL UNIVERSITY 41