Page 130 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 130

Unit 5: Transfer Pricing

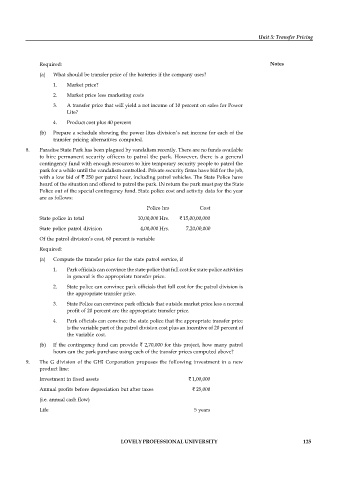

Required: Notes

(a) What should be transfer price of the batteries if the company uses?

1. Market price?

2. Market price less marketing costs

3. A transfer price that will yield a net income of 10 percent on sales for Power

Lite?

4. Product cost plus 40 percent

(b) Prepare a schedule showing the power lites division’s net income for each of the

transfer pricing alternatives computed.

8. Paradise State Park has been plagued by vandalism recently. There are no funds available

to hire permanent security officers to patrol the park. However, there is a general

contingency fund with enough resources to hire temporary security people to patrol the

park for a while until the vandalism controlled. Private security firms have bid for the job,

with a low bid of ` 250 per patrol hour, including patrol vehicles. The State Police have

heard of the situation and offered to patrol the park. IN return the park must pay the State

Police out of the special contingency fund. State police cost and activity data for the year

are as follows:

Police hrs Cost

State police in total 10,00,000 Hrs. ` 15,00,00,000

State police patrol division 4,00,000 Hrs. 7,20,00,000

Of the patrol division’s cost, 60 percent is variable

Required:

(a) Compute the transfer price for the state patrol service, if

1. Park officials can convince the state police that full cost for state police activities

in general is the appropriate transfer price.

2. State police can convince park officials that full cost for the patrol division is

the appropriate transfer price.

3. State Police can convince park officials that outside market price less a normal

profit of 20 percent are the appropriate transfer price.

4. Park officials can convince the state police that the appropriate transfer price

is the variable part of the patrol division cost plus an incentive of 20 percent of

the variable cost.

(b) If the contingency fund can provide ` 2,70,000 for this project, how many patrol

hours can the park purchase using each of the transfer prices computed above?

9. The G division of the GHI Corporation proposes the following investment in a new

product line:

Investment in fixed assets ` 1,00,000

Annual profits before depreciation but after taxes ` 25,000

(i.e. annual cash flow)

Life 5 years

LOVELY PROFESSIONAL UNIVERSITY 125