Page 128 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 128

Unit 5: Transfer Pricing

Notes

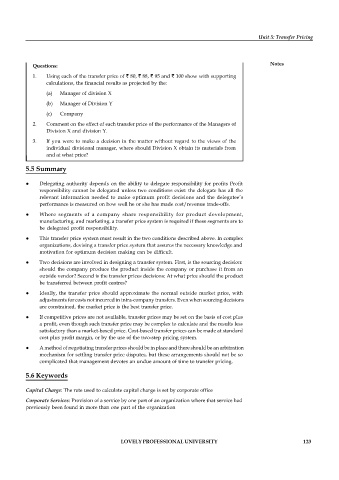

Questions:

1. Using each of the transfer price of ` 80, ` 88, ` 95 and ` 100 show with supporting

calculations, the financial results as projected by the:

(a) Manager of division X

(b) Manager of Division Y

(c) Company

2. Comment on the effect of each transfer price of the performance of the Managers of

Division X and division Y.

3. If you were to make a decision in the matter without regard to the views of the

individual divisional manager, where should Division X obtain its materials from

and at what price?

5.5 Summary

Delegating authority depends on the ability to delegate responsibility for profits Profit

responsibility cannot be delegated unless two conditions exist: the delegate has all the

relevant information needed to make optimum profit decisions and the delegatee’s

performance is measured on how well he or she has made cost/revenue trade-offs.

Where segments of a company share responsibility for product development,

manufacturing, and marketing, a transfer price system is required if these segments are to

be delegated profit responsibility.

This transfer price system must result in the two conditions described above. In complex

organizations, devising a transfer price system that assures the necessary knowledge and

motivation for optimum decision making can be difficult.

Two decisions are involved in designing a transfer system. First, is the sourcing decision:

should the company produce the product inside the company or purchase it from an

outside vendor? Second is the transfer prices decisions: At what price should the product

be transferred between profit centres?

Ideally, the transfer price should approximate the normal outside market price, with

adjustments for costs not incurred in intra-company transfers. Even when sourcing decisions

are constrained, the market price is the best transfer price.

If competitive prices are not available, transfer prices may be set on the basis of cost plus

a profit, even though such transfer price may be complex to calculate and the results less

satisfactory than a market-based price. Cost-based transfer prices can be made at standard

cost plus profit margin, or by the use of the two-step pricing system.

A method of negotiating transfer prices should be in place and there should be an arbitration

mechanism for settling transfer price disputes, but these arrangements should not be so

complicated that management devotes an undue amount of time to transfer pricing.

5.6 Keywords

Capital Charge: The rate used to calculate capital charge is set by corporate office

Corporate Services: Provision of a service by one part of an organization where that service had

previously been found in more than one part of the organization

LOVELY PROFESSIONAL UNIVERSITY 123