Page 124 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 124

Unit 5: Transfer Pricing

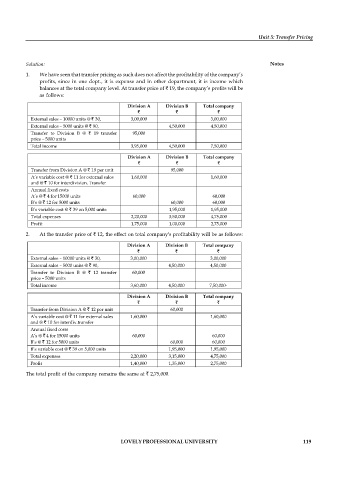

Solution: Notes

1. We have seen that transfer pricing as such does not affect the profitability of the company’s

profits, since in one dept., it is expense and in other department, it is income which

balances at the total company level. At transfer price of ` 19, the company’s profits will be

as follows:

Division A Division B Total company

` ` `

External sales – 10000 units @ ` 30, 3,00,000 3,00,000

External sales – 5000 units @ ` 90, 4,50,000 4,50,000

Transfer to Division B @ ` 19 transfer 95,000

price – 5000 units

Total income 3,95,000 4,50,000 7,50,000

Division A Division B Total company

` ` `

Transfer from Division A @ ` 19 per unit 95,000

A’s variable cost @ ` 11 for external sales 1,60,000 1,60,000

and @ ` 10 for interdivision. Transfer

Annual fixed costs

A’s @ ` 4 for 15000 units 60,000 60,000

B’s @ ` 12 for 5000 units 60,000 60,000

B’s variable cost @ ` 39 on 5,000 units 1,95,000 1,95,000

Total expenses 2,20,000 3,50,000 4,75,000

Profit 1,75,000 1,00,000 2,75,000

2. At the transfer price of ` 12, the effect on total company's profitability will be as follows:

Division A Division B Total company

` ` `

External sales – 10000 units @ ` 30, 3,00,000 3,00,000

External sales – 5000 units @ ` 90, 4,50,000 4,50,000

Transfer to Division B @ ` 12 transfer 60,000

price – 5000 units

Total income 3,60,000 4,50,000 7,50,000-

Division A Division B Total company

` ` `

Transfer from Division A @ ` 12 per unit 60,000

A’s variable cost @ ` 11 for external sales 1,60,000 1,60,000

and @ ` 10 for interdiv.transfer

Annual fixed costs

A’s @ ` 4 for 15000 units 60,000 60,000

B’s @ ` 12 for 5000 units 60,000 60,000

B’s variable cost @ ` 39 on 5,000 units 1,95,000 1,95,000

Total expenses 2,20,000 3,15,000 4,75,000

Profit 1,40,000 1,35,000 2,75,000

The total profit of the company remains the same at ` 2,75,000.

LOVELY PROFESSIONAL UNIVERSITY 119