Page 119 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 119

Management Control Systems

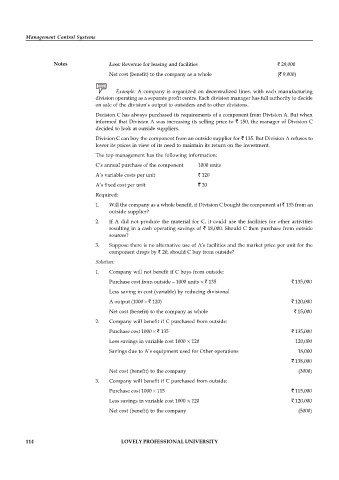

Notes Less: Revenue for leasing and facilities ` 29,000

Net cost (benefit) to the company as a whole (` 9,000)

Example: A company is organized on decentralized lines, with each manufacturing

division operating as a separate profit centre. Each division manager has full authority to decide

on sale of the division’s output to outsiders and to other divisions.

Decision C has always purchased its requirements of a component from Division A. But when

informed that Division A was increasing its selling price to ` 150, the manager of Division C

decided to look at outside suppliers.

Division C can buy the component from an outside supplier for ` 135. But Division A refuses to

lower its prices in view of its need to maintain its return on the investment.

The top management has the following information:

C’s annual purchase of the component 1000 units

A’s variable costs per unit ` 120

A’s fixed cost per unit ` 20

Required:

1. Will the company as a whole benefit, if Division C bought the component at ` 135 from an

outside supplier?

2. If A did not produce the material for C, it could use the facilities for other activities

resulting in a cash operating savings of ` 18,000. Should C then purchase from outside

sources?

3. Suppose there is no alternative use of A’s facilities and the market price per unit for the

component drops by ` 20, should C buy from outside?

Solution:

1. Company will not benefit if C buys from outside:

Purchase cost from outside – 1000 units ` 135 ` 135,000

Less saving in cost (variable) by reducing divisional

A output (1000 ` 120) ` 120,000

Net cost (benefit) to the company as whole ` 15,000

2. Company will benefit if C purchased from outside:

Purchase cost 1000 ` 135 ` 135,000

Less savings in variable cost 1000 120 120,000

Savings due to A’s equipment used for Other operations 18,000

` 138,000

Net cost (benefit) to the company (3000)

3. Company will benefit if C purchased from outside:

Purchase cost 1000 115 ` 115,000

Less savings in variable cost 1000 120 ` 120,000

Net cost (benefit) to the company (5000)

114 LOVELY PROFESSIONAL UNIVERSITY