Page 115 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 115

Management Control Systems

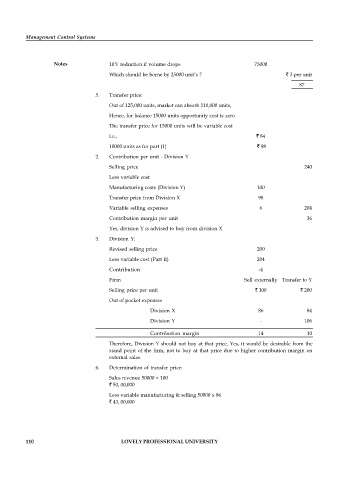

Notes 10% reduction if volume drops 75000

Which should be borne by 25000 unit’s ? ` 3 per unit

87

5. Transfer price:

Out of 125,000 units, market can absorb 110,000 units,

Hence, for balance 15000 units opportunity cost is zero

The transfer price for 15000 units will be variable cost

i.e., ` 84

10000 units as for part (1) ` 98

2. Contribution per unit - Division Y

Selling price 240

Less variable cost

Manufacturing costs (Division Y) 100

Transfer price from Division X 98

Variable selling expenses 6 204

Contribution margin per unit 36

Yes, division Y is advised to buy from division X

3. Division Y:

Revised selling price 200

Less variable cost (Part II) 204

Contribution -4

Firm Sell externally Transfer to Y

Selling price per unit ` 100 ` 200

Out of pocket expenses

Division X 86 84

Division Y - 106

Contribution margin 14 10

Therefore, Division Y should not buy at that price. Yes, it would be desirable from the

stand point of the firm, not to buy at that price due to higher contribution margin on

external sales.

6. Determination of transfer price:

Sales revenue 50000 × 100

` 50, 00,000

Less variable manufacturing & selling 50000 x 86

` 43, 00,000

110 LOVELY PROFESSIONAL UNIVERSITY