Page 116 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 116

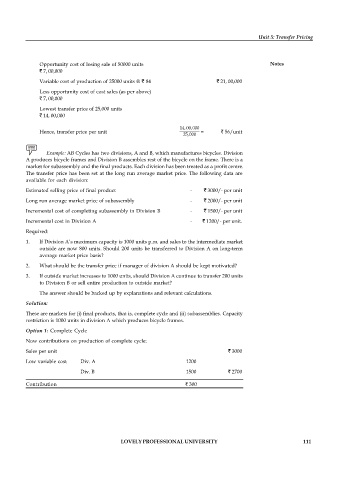

Unit 5: Transfer Pricing

Opportunity cost of losing sale of 50000 units Notes

` 7, 00,000

Variable cost of production of 25000 units @ ` 84 ` 21, 00,000

Less opportunity cost of cost sales (as per above)

` 7, 00,000

Lowest transfer price of 25,000 units

` 14, 00,000

14, 00,000

Hence, transfer price per unit = ` 56/unit

25,000

Example: AB Cycles has two divisions, A and B, which manufactures bicycles. Division

A produces bicycle frames and Division B assembles rest of the bicycle on the frame. There is a

market for subassembly and the final products. Each division has been treated as a profit centre.

The transfer price has been set at the long run average market price. The following data are

available for each division:

Estimated selling price of final product - ` 3000/- per unit

Long run average market price of subassembly - ` 2000/- per unit

Incremental cost of completing subassembly in Division B - ` 1500/- per unit

Incremental cost in Division A - ` 1200/- per unit.

Required:

1. If Division A’s maximum capacity is 1000 units p.m. and sales to the intermediate market

outside are now 800 units. Should 200 units be transferred to Division A on long-term

average market price basis?

2. What should be the transfer price if manager of division A should be kept motivated?

3. If outside market increases to 1000 units, should Division A continue to transfer 200 units

to Division B or sell entire production to outside market?

The answer should be backed up by explanations and relevant calculations.

Solution:

These are markets for (i) final products, that is, complete cycle and (ii) subassemblies. Capacity

restriction is 1000 units in division A which produces bicycle frames.

Option 1: Complete Cycle

Now contributions on production of complete cycle:

Sales per unit ` 3000

Low variable cost Div. A 1200

Div. B 1500 ` 2700

Contribution ` 300

LOVELY PROFESSIONAL UNIVERSITY 111