Page 113 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 113

Management Control Systems

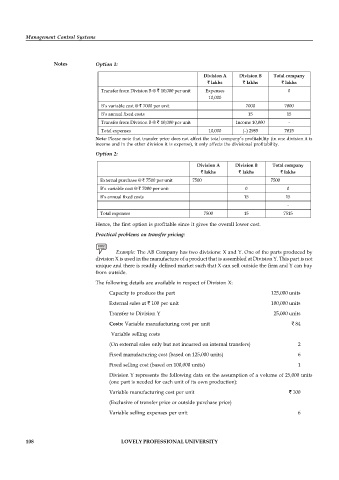

Notes Option 1:

Division A Division B Total company

` lakhs ` lakhs ` lakhs

Transfer from Division B @ ` 10,000 per unit Expenses 0

10,000

B’s variable cost @ ` 7000 per unit 7000 7000

B’s annual fixed costs 15 15

Transfer from Division B @ ` 10,000 per unit Income 10,000 -

Total expenses 10,000 (–) 2985 7015

Note: Please note that transfer price does not affect the total company’s profitability (in one division it is

income and in the other division it is expense), it only affects the divisional profitability.

Option 2:

Division A Division B Total company

` lakhs ` lakhs ` lakhs

External purchase @ ` 7500 per unit 7500 7500

B’s variable cost @ ` 7000 per unit 0 0

B’s annual fixed costs 15 15

-

Total expenses 7500 15 7515

Hence, the first option is profitable since it gives the overall lower cost.

Practical problems on transfer pricing:

Example: The AB Company has two divisions: X and Y. One of the parts produced by

division X is used in the manufacture of a product that is assembled at Division Y. This part is not

unique and there is readily defined market such that X can sell outside the firm and Y can buy

from outside.

The following details are available in respect of Division X:

Capacity to produce the part 125,000 units

External sales at ` 100 per unit 100,000 units

Transfer to Division Y 25,000 units

Costs: Variable manufacturing cost per unit ` 84

Variable selling costs

(On external sales only but not incurred on internal transfers) 2

Fixed manufacturing cost (based on 125,000 units) 6

Fixed selling cost (based on 100,000 units) 1

Division Y represents the following data on the assumption of a volume of 25,000 units

(one part is needed for each unit of its own production):

Variable manufacturing cost per unit ` 100

(Exclusive of transfer price or outside purchase price)

Variable selling expenses per unit 6

108 LOVELY PROFESSIONAL UNIVERSITY