Page 178 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 178

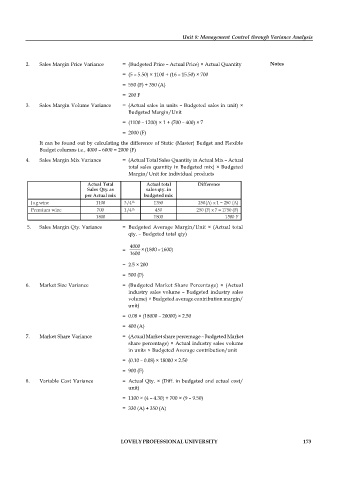

Unit 8: Management Control through Variance Analysis

2. Sales Margin Price Variance = (Budgeted Price – Actual Price) × Actual Quantity Notes

= (5 – 5.50) × 1100 + (16 – 15.50) × 700

= 550 (F) + 350 (A)

= 200 F

3. Sales Margin Volume Variance = (Actual sales in units – Budgeted sales in unit) ×

Budgeted Margin/Unit

= (1100 – 1200) × 1 + (700 – 400) × 7

= 2000 (F)

It can be found out by calculating the difference of Static (Master) Budget and Flexible

Budget columns i.e., 4000 – 6000 = 2000 (F)

4. Sales Margin Mix Variance = (Actual Total Sales Quantity in Actual Mix – Actual

total sales quantity in Budgeted mix) × Budgeted

Margin/Unit for individual products

Actual Total Actual total Difference

Sales Qty. as sales qty. in

per Actual mix budgeted mix

th

Jug wine 1100 3/4 1350 250(A) x 1 = 250 (A)

th

Premium wine 700 1/4 450 250 (F) x 7 = 1750 (F)

1800 1800 1500 F

5. Sales Margin Qty. Variance = Budgeted Average Margin/Unit × (Actual total

qty. – Budgeted total qty)

4000

= × (1800 – 1600)

1600

= 2.5 × 200

= 500 (F)

6. Market Size Variance = (Budgeted Market Share Percentage) × (Actual

industry sales volume – Budgeted industry sales

volume) × Budgeted average contribution margin/

unit)

= 0.08 × (18000 – 20000) × 2.50

= 400 (A)

7. Market Share Variance = (Actual Market share percentage – Budgeted Market

share percentage) × Actual industry sales volume

in units × Budgeted Average contribution/unit

= (0.10 – 0.08) × 18000 × 2.50

= 900 (F)

8. Variable Cost Variance = Actual Qty. × (Diff. in budgeted and actual cost/

unit)

= 1100 × (4 – 4.30) + 700 × (9 – 9.50)

= 330 (A) + 350 (A)

LOVELY PROFESSIONAL UNIVERSITY 173