Page 96 - DMGT523_LOGISTICS_AND_SUPPLY_CHAIN_MANAGEMENT

P. 96

Unit 4: Demand Planning and Forecasting

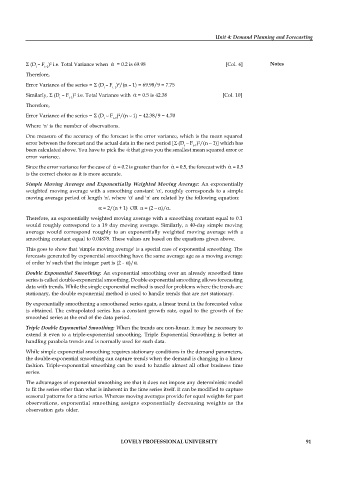

(D – F )² i.e. Total Variance when = 0.2 is 69.98 [Col. 6] Notes

t t–1

Therefore,

Error Variance of the series = (D – F )²/(n – 1) = 69.98/9 = 7.75

t t–1

Similarly, (D – F )² i.e. Total Variance with = 0.5 is 42.38 [Col. 10]

t t–1

Therefore,

Error Variance of the series = (D – F )²/(n – 1) = 42.38/9 = 4.70

t t–1

Where 'n' is the number of observations.

One measure of the accuracy of the forecast is the error variance, which is the mean squared

error between the forecast and the actual data in the next period [ (D – F )²/(n – 1)] which has

t t–1

been calculated above. You have to pick the that gives you the smallest mean squared error or

error variance.

Since the error variance for the case of = 0.2 is greater than for = 0.5, the forecast with = 0.5

is the correct choice as it is more accurate.

Simple Moving Average and Exponentially Weighted Moving Average: An exponentially

weighted moving average with a smoothing constant ' ', roughly corresponds to a simple

moving average period of length 'n', where ' ' and 'n' are related by the following equation:

= 2/(n + 1) OR n = (2 – )/ .

Therefore, an exponentially weighted moving average with a smoothing constant equal to 0.1

would roughly correspond to a 19 day moving average. Similarly, a 40-day simple moving

average would correspond roughly to an exponentially weighted moving average with a

smoothing constant equal to 0.04878. These values are based on the equations given above.

This goes to show that 'simple moving average' is a special case of exponential smoothing. The

forecasts generated by exponential smoothing have the same average age as a moving average

of order 'n' such that the integer part is (2 - )/ .

Double Exponential Smoothing: An exponential smoothing over an already smoothed time

series is called double-exponential smoothing. Double exponential smoothing allows forecasting

data with trends. While the single exponential method is used for problems where the trends are

stationary, the double exponential method is used to handle trends that are not stationary.

By exponentially smoothening a smoothened series again, a linear trend in the forecasted value

is obtained. The extrapolated series has a constant growth rate, equal to the growth of the

smoothed series at the end of the data period.

Triple Double Exponential Smoothing: When the trends are non-linear, it may be necessary to

extend it even to a triple-exponential smoothing. Triple Exponential Smoothing is better at

handling parabola trends and is normally used for such data.

While simple exponential smoothing requires stationary conditions in the demand parameters,

the double-exponential smoothing can capture trends when the demand is changing in a linear

fashion. Triple-exponential smoothing can be used to handle almost all other business time

series.

The advantages of exponential smoothing are that it does not impose any deterministic model

to fit the series other than what is inherent in the time series itself. It can be modified to capture

seasonal patterns for a time series. Whereas moving averages provide for equal weights for past

observations, exponential smoothing assigns exponentially decreasing weights as the

observation gets older.

LOVELY PROFESSIONAL UNIVERSITY 91