Page 171 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 171

International Financial Management

Notes (d) Raising Productivity: Raising productivity through closing inefficient plants, automating

heavily and negotiating wage and benefit cutbacks and work rule concessions is another

alternative to manage economic exposure. Employee motivation can also be used to

heighten productivity and improve product quality.

Self Assessment

Fill in the blanks:

7. …………………… strategy should take into account anticipated exchange rate changes.

8. Companies can also respond to exchange rate changes by altering their ……………………

strategy, which deals with such areas as new product introduction.

9. …………………… motivation can also be used to heighten productivity and improve

product quality.

10. A strategy of …………………… shifting presupposes that a company has already created

a portfolio of plants worldwide.

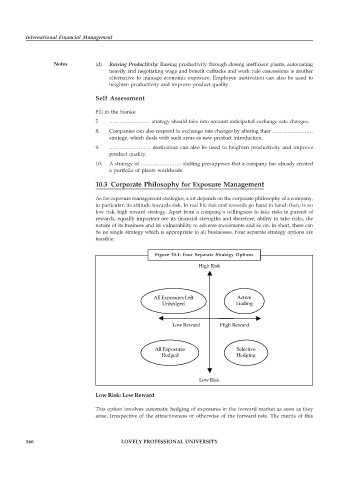

10.3 Corporate Philosophy for Exposure Management

As for exposure management strategies, a lot depends on the corporate philosophy of a company,

in particular, its attitude towards risk. In real life risk and rewards go hand in hand: there is no

low risk, high reward strategy. Apart from a company’s willingness to take risks in pursuit of

rewards, equally important are its financial strengths and therefore, ability to take risks, the

nature of its business and its vulnerability to adverse movements and so on. In short, there can

be no single strategy which is appropriate to all businesses. Four separate strategy options are

feasible.

Figure 10.1: Four Separate Strategy Options

High Risk

All Exposures Left Active

Unhedged Trading

Low Reward High Reward

All Exposures Selective

Hedged Hedging

Low Risk

Low Risk: Low Reward

This option involves automatic hedging of exposures in the forward market as soon as they

arise, irrespective of the attractiveness or otherwise of the forward rate. The merits of this

166 LOVELY PROFESSIONAL UNIVERSITY