Page 175 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 175

International Financial Management

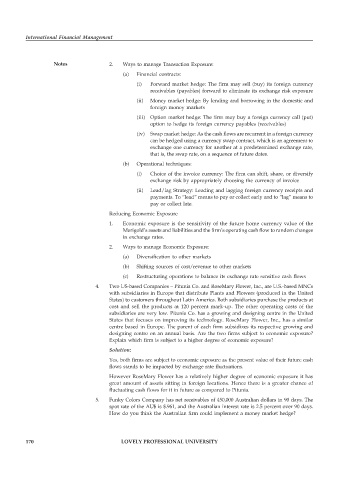

Notes 2. Ways to manage Transaction Exposure:

(a) Financial contracts:

(i) Forward market hedge: The firm may sell (buy) its foreign currency

receivables (payables) forward to eliminate its exchange risk exposure

(ii) Money market hedge: By lending and borrowing in the domestic and

foreign money markets

(iii) Option market hedge: The firm may buy a foreign currency call (put)

option to hedge its foreign currency payables (receivables)

(iv) Swap market hedge: As the cash flows are recurrent in a foreign currency

can be hedged using a currency swap contract, which is an agreement to

exchange one currency for another at a predetermined exchange rate,

that is, the swap rate, on a sequence of future dates.

(b) Operational techniques:

(i) Choice of the invoice currency: The firm can shift, share, or diversify

exchange risk by appropriately choosing the currency of invoice

(ii) Lead/lag Strategy: Leading and lagging foreign currency receipts and

payments. To “lead” means to pay or collect early and to “lag” means to

pay or collect late.

Reducing Economic Exposure

1. Economic exposure is the sensitivity of the future home currency value of the

Marigold’s assets and liabilities and the firm’s operating cash flow to random changes

in exchange rates.

2. Ways to manage Economic Exposure:

(a) Diversification to other markets

(b) Shifting sources of cost/revenue to other markets

(c) Restructuring operations to balance its exchange rate sensitive cash flows

4. Two US-based Companies – Pitunia Co. and RoseMary Flower, Inc., are U.S.-based MNCs

with subsidiaries in Europe that distribute Plants and Flowers (produced in the United

States) to customers throughout Latin America. Both subsidiaries purchase the products at

cost and sell the products at 120 percent mark-up. The other operating costs of the

subsidiaries are very low. Pitunia Co. has a growing and designing centre in the United

States that focuses on improving its technology. RoseMary Flower, Inc., has a similar

centre based in Europe. The parent of each firm subsidizes its respective growing and

designing centre on an annual basis. Are the two firms subject to economic exposure?

Explain which firm is subject to a higher degree of economic exposure?

Solution:

Yes, both firms are subject to economic exposure as the present value of their future cash

flows stands to be impacted by exchange rate fluctuations.

However RoseMary Flower has a relatively higher degree of economic exposure it has

great amount of assets sitting in foreign locations. Hence there is a greater chance of

fluctuating cash flows for it in future as compared to Pitunia.

5. Funky Colors Company has net receivables of 450,000 Australian dollars in 90 days. The

spot rate of the AU$ is $.961, and the Australian interest rate is 2.5 percent over 90 days.

How do you think the Australian firm could implement a money market hedge?

170 LOVELY PROFESSIONAL UNIVERSITY