Page 16 - DMGT553_RETAIL_STORE_MANAGEMENT

P. 16

Unit 1: Introduction: An Overview of Retail Operations

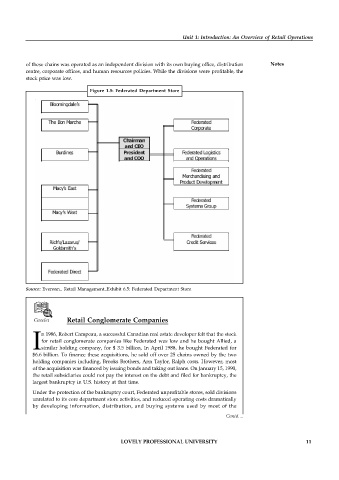

of these chains was operated as an independent division with its own buying office, distribution Notes

centre, corporate offices, and human resources policies. While the divisions were profitable, the

stock price was low.

Figure 1.5: Federated Department Store

Source: Everonn_ Retail Management_Exhibit 6.5: Federated Department Store

Caselet Retail Conglomerate Companies

n 1986, Robert Campeau, a successful Canadian real estate developer felt that the stock

for retail conglomerate companies like Federated was low and he bought Allied, a

Isimilar holding company, for $ 3.5 billion, In April 1988, he bought Federated for

$6.6 billion. To finance these acquisitions, he sold off over 25 chains owned by the two

holding companies including, Brooks Brothers, Ann Taylor, Ralph costs. However, most

of the acquisition was financed by issuing bonds and taking out loans. On January 15, 1990,

the retail subsidiaries could not pay the interest on the debt and filed for bankruptcy, the

largest bankruptcy in U.S. history at that time.

Under the protection of the bankruptcy court, Federated unprofitable stores, sold divisions

unrelated to its core department store activities, and reduced operating costs dramatically

by developing information, distribution, and buying systems used by most of the

Contd....

LOVELY PROFESSIONAL UNIVERSITY 11