Page 190 - DMGT554_RETAIL_BUYING

P. 190

Unit 12: Merchandise Pricing

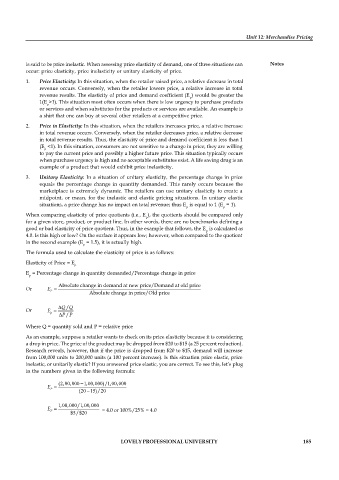

is said to be price inelastic. When assessing price elasticity of demand, one of three situations can Notes

occur: price elasticity, price inelasticity or unitary elasticity of price.

1. Price Elasticity: In this situation, when the retailer raised price, a relative decrease in total

revenue occurs. Conversely, when the retailer lowers price, a relative increase in total

revenue results. The elasticity of price and demand coefficient (E ) would be greater the

p

1(E >1). This situation most often occurs when there is low urgency to purchase products

p

or services and when substitutes for the products or services are available. An example is

a shirt that one can buy at several other retailers at a competitive price.

2. Price in Elasticity: In this situation, when the retailers increases price, a relative increase

in total revenue occurs. Conversely, when the retailer decreases price, a relative decrease

in total revenue results. Thus, the elasticity of price and demand coefficient is less than 1

(E <1). In this situation, consumers are not sensitive to a change in price; they are willing

p

to pay the current price and possibly a higher future price. This situation typically occurs

when purchase urgency is high and no acceptable substitutes exist. A life saving drug is an

example of a product that would exhibit price inelasticity.

3. Unitary Elasticity: In a situation of unitary elasticity, the percentage change in price

equals the percentage change in quantity demanded. This rarely occurs because the

marketplace is extremely dynamic. The retailers can use unitary elasticity to create a

midpoint, or mean, for the inelastic and elastic pricing situations. In unitary elastic

situations, a price change has no impact on total revenue; thus E is equal to 1 (E = 1).

p p

When comparing elasticity of price quotients (i.e., E ), the quotients should be compared only

p

for a given store, product, or product line. In other words, there are no benchmarks defining a

good or bad elasticity of price quotient. Thus, in the example that follows, the E is calculated as

p

4.0. Is this high or low? On the surface it appears low; however, when compared to the quotient

in the second example (E = 1.5), it is actually high.

p

The formula used to calculate the elasticity of price is as follows:

Elasticity of Price = E

p

E = Percentage change in quantity demanded/Percentage change in price

p

Absolute change in demand at new price/Demand at old price

Or E

P

Absolute change in price/Old price

Q /Q

Or E

p

P /P

Where Q = quantity sold and P = relative price

As an example, suppose a retailer wants to check on its price elasticity because it is considering

a drop in price. The price of the product may be dropped from $20 to $15 (a 25 percent reduction).

Research reveals, however, that if the price is dropped from $20 to $15, demand will increase

from 100,000 units to 200,000 units (a 100 percent increase). Is this situation price elastic, price

inelastic, or unitarily elastic? If you answered price elastic, you are correct. To see this, let’s plug

in the numbers given in the following formula:

/

,

)

,

,

,

,

,

( 2 00 000 1 00 000 1 00 000

E

P

( 20 15)/ 20

,

,

/

,

,

1 00 000 1 00 000

E = 4.0 or 100%/25% = 4.0

P

$ 5/$ 20

LOVELY PROFESSIONAL UNIVERSITY 185