Page 72 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 72

Financial Accounting-I

Notes

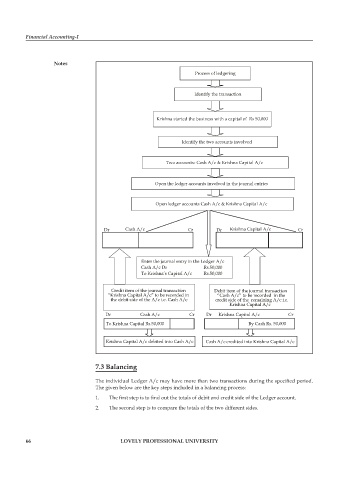

Process of ledgering

Identify the transaction

Krishna started the business with a capital of Rs 50,000

Identify the two accounts involved

Two accounts- Cash A/c & Krishna Capital A/c

Open the ledger accounts involved in the journal entries

Open ledger accounts Cash A/c & Krishna Capital A/c

Dr Cash A/c Cr Dr Krishna Capital A/c Cr

Enter the journal entry in the Ledger A/c

Cash A/c Dr Rs.50,000

To Krishna’s Capital A/c Rs.50,000

Credit item of the journal transaction Debit item of the journal transaction

“Krishna Capital A/c” to be recorded in “Cash A/c” to be recorded in the

the debit side of the A/c i.e. Cash A/c credit side of the remaining A/c i.e.

Krishna Capital A/c

Dr Cash A/c Cr Dr Krishna Capital A/c Cr

To Krishna Capital Rs.50,000 By Cash Rs. 50,000

Krishna Capital A/c debited into Cash A/c Cash A/c credited into Krishna Capital A/c

7.3 Balancing

The individual Ledger A/c may have more than two transactions during the specifi ed period.

The given below are the key steps included in a balancing process:

1. The first step is to find out the totals of debit and credit side of the Ledger account.

2. The second step is to compare the totals of the two different sides.

66 LOVELY PROFESSIONAL UNIVERSITY