Page 75 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 75

Unit 7: Posting to Ledger and Balancing

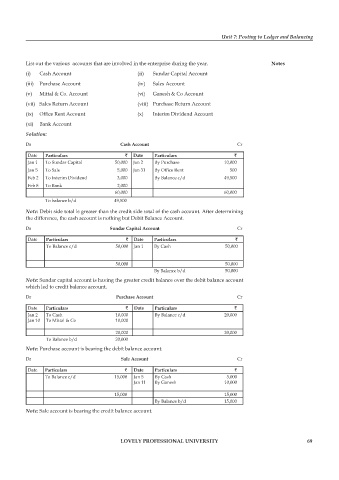

List out the various accounts that are involved in the enterprise during the year. Notes

(i) Cash Account (ii) Sundar Capital Account

(iii) Purchase Account (iv) Sales Account

(v) Mittal & Co. Account (vi) Ganesh & Co Account

(vii) Sales Return Account (viii) Purchase Return Account

(ix) Office Rent Account (x) Interim Dividend Account

(xi) Bank Account

Solution:

Dr Cash Account Cr

Date Particulars ` Date Particulars `

Jan 1 To Sundar Capital 50,000 Jan 2 By Purchase 10,000

Jan 5 To Sale 5,000 Jan 31 By Office Rent 500

Feb 2 To Interim Dividend 3,000 By Balance c/d 49,500

Feb 8 To Bank 2,000

60,000 60,000

To balance b/d 49,500

Note: Debit side total is greater than the credit side total of the cash account. After determining

the difference, the cash account is nothing but Debit Balance Account.

Dr Sundar Capital Account Cr

Date Particulars ` Date Particulars `

To Balance c/d 50,000 Jan 1 By Cash 50,000

50,000 50,000

By Balance b/d 50,000

Note: Sundar capital account is having the greater credit balance over the debit balance account

which led to credit balance account.

Dr Purchase Account Cr

Date Particulars ` Date Particulars `

Jan 2 To Cash 10,000 By Balance c/d 20,000

Jan 10 To Mittal & Co 10,000

20,000 20,000

To Balance b/d 20,000

Note: Purchase account is bearing the debit balance account.

Dr Sale Account Cr

Date Particulars ` Date Particulars `

To Balance c/d 15,000 Jan 5 By Cash 5,000

Jan 11 By Ganesh 10,000

15,000 15,000

By Balance b/d 15,000

Note: Sale account is bearing the credit balance account.

LOVELY PROFESSIONAL UNIVERSITY 69