Page 73 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 73

Unit 7: Posting to Ledger and Balancing

3. The third step is to find out the total of which side is greater over the other. Notes

4. The fourth step is to identify the difference among the two side's balances i.e. debit and

credit side totals.

5. The fifth step is the most important step which balances the difference on the total of the

side which bears lesser total over the greater.

6. If the balance of the debit side of the ledger is more than the credit side it is called as Debit

balance ledger and vice versa in the case of Credit balance ledger.

7. The closing balance of one ledger account will automatically become an opening balance of

the same ledger account for the next accounting period.

Balancing of Different types of Accounts

Assets: All asset accounts are balanced. These accounts always have a debit balance.

Liabilities: All Liability accounts are balanced. All these accounts have a credit balance.

Capital: This account is always balanced and usually has a credit balance.

Expense and Revenues: These Accounts are not balanced but are simply totaled up. The debit

total of Expense/Loss will show the expense/Loss. In the same manner, credit total of Revenue/

Income will show increase in income. At the time of preparing the Trial Balance, the totals of

these are taken to the Trial Balance.

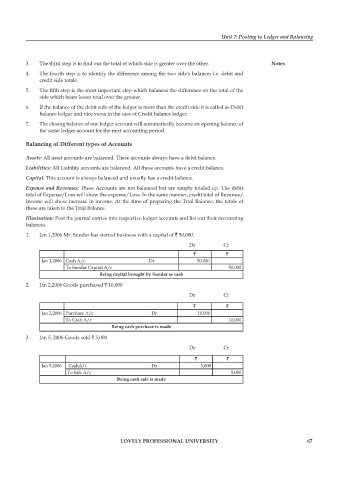

Illustration: Post the journal entries into respective ledger accounts and list out their accounting

balances.

1. Jan 1,2006 Mr. Sundar has started business with a capital of ` 50,000.

Dr Cr

` `

Jan 1,2006 Cash A/c Dr 50,000

To Sundar Capital A/c 50,000

Being capital brought by Sundar as cash

2. Jan 2,2006 Goods purchased ` 10,000

Dr Cr

` `

Jan 2,2006 Purchase A/c Dr 10,000

To Cash A/c 10,000

Being cash purchase is made

3. Jan 5, 2006 Goods sold ` 5,000

Dr Cr

` `

Jan 5,2006 CashA/c Dr 5,000

To Sale A/c 5,000

Being cash sale is made

LOVELY PROFESSIONAL UNIVERSITY 67