Page 148 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 148

Unit 6: Debentures: Concept, Types, Issue

various instalments and any or some instalments are not paid by the debenture-holder, that Notes

amount which is not paid by the debenture-holder is known as calls-in-arrear. For unpaid

amount on any call, no separate account is maintained in the books. The amount of calls-in-

arrear is substracted from the paid-up value of debenture in the liabilities side of the balance

sheet. If there is no provision regarding the interest in calls-in-arrear on debentures, interest is

not calculated on arrears.

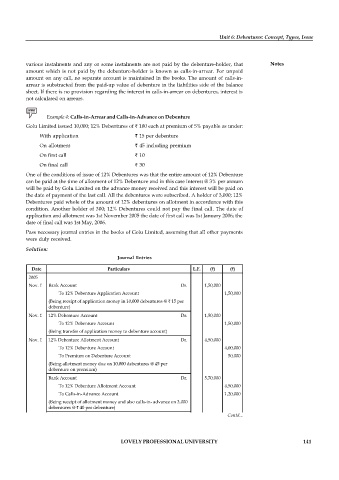

Example 4: Calls-in-Arrear and Calls-in-Advance on Debenture

Golu Limited issued 10,000; 12% Debentures of 100 each at premium of 5% payable as under:

With application 15 per debenture

On allotment 45 including premium

On first call 10

On final call 30

One of the conditions of issue of 12% Debentures was that the entire amount of 12% Debenture

can be paid at the time of allotment of 12% Debenture and in this case interest @ 3% per annum

will be paid by Golu Limited on the advance money received and this interest will be paid on

the date of payment of the last call. All the debentures were subscribed. A holder of 3,000; 12%

Debentures paid whole of the amount of 12% debentures on allotment in accordance with this

condition. Another holder of 300; 12% Debentures could not pay the final call. The date of

application and allotment was 1st November 2005 the date of first call was 1st January 2006; the

date of final call was 1st May, 2006.

Pass necessary journal entries in the books of Golu Limited, assuming that all other payments

were duly received.

Solution:

Journal Entries

Date Particulars L.F. ( ) ( )

2005

Nov. 1 Bank Account Dr. 1,50,000

To 12% Debenture Application Account 1,50,000

(Being receipt of application money in 10,000 debentures @ 15 per

debenture)

Nov. 1 12% Debenture Account Dr. 1,50,000

To 12% Debenture Account 1,50,000

(Being transfer of application money to debenture account)

Nov. 1 12% Debenture Allotment Account Dr. 4,50,000

To 12% Debenture Account 4,00,000

To Premium on Debenture Account 50,000

(Being allotment money due on 10,000 debentures @ 45 per

debenture on premium)

Bank Account Dr. 5,70,000

To 12% Debenture Allotment Account 4,50,000

To Calls-in-Advance Account 1,20,000

(Being receipt of allotment money and also calls-in- advance on 3,000

debentures @ 40 per debenture)

2006 Contd...

Jan. 1 12% Debenture First Call Account Dr. 1,00,000

To 12% Debenture Account 1,00,000

(Being first call money due on 10,000 debenture @ 10 each) 141

LOVELY PROFESSIONAL UNIVERSITY

Bank Account Dr. 70,000

Call-in-Advance Account Dr. 30,000

To 12% Debenture First Call Account 1,00,000

(Being receipt of first call money and calls-in-advance adjusted)

May, 1 12% Debenture Second & Final Call Account Dr. 3,00,000

To 12% Debenture Account 3,00,000

(Being second and final call money due on 10,000 debenture @ 30

per debenture)

Bank Account Dr. 2,01,000

Calls-in-advance Account Dr. 90,000

To 12% Debenture Second and Final Call Account 2,91,000

(Being receipt of second and final call on 6,700 debenture and calls-

in-advance adjusted)

Interest on calls in advance Account Dr. 1,500

To Bank Account 1,500

(Interest on calls in advance paid to Debenture-holders)